Risevest vs. PiggyVest- The Ultimate Comparison in 2023

In today’s content, we will discuss Risevest vs. PiggyVest and show you all there’s to know about both investment platforms.

Risevest and PiggyVest are both fintech giant companies offering the same features with nearly minor differences.

To help you make an informed decision, we will go over the following:

- Both companies’ overview

- The features

- Key differences

- Existing user reviews

- Pros and Cons, etc.

We will also tell you what we believe to be true about both platforms so that you can make an informed decision.

Let’s start!

Contents

- Risevest Overview

- PiggyVest Overview

- Risevest vs. PiggyVest: Key Differences

- Risevest vs. PiggyVest: Reviews

- Risevest Reviews

- PiggyVest Reviews

- Risevest vs. PiggyVest: Pros & Cons

- Frequently Asked Questions

- Final thoughts

Risevest Overview

Risevest is a digital dollar asset manager that connects Nigerians to foreign investment opportunities through products such as fixed income, US real estate, and US stocks.

With this, Risevest provides dollar investment to help everyone grow since they usually invest in dollars.

Risevest puts your money in high-quality assets that help you build wealth over time and achieve your financial goals.

Here, you invest your money in a stable currency, the dollar.

By holding your investments in a stable currency, your money grows over time and retains its value better.

One of this platform’s advantages is that you can choose what is best for you.

Unlike other platforms, Rise lets you pick between stocks, US real estate, and fixed income, according to your risk appetite.

That way, you can spread your risk and tap into different investments all in one place.

Sounds good right?, Yes, it’s!

In addition, you can also set goals and reach them easily.

You can invest towards a goal on the rise–retirement, higher education, saving for your home, or travel budgets.

Or create a goal of your own and invest periodically to achieve them.

Risevest also makes sure that they remember you at all times so that you don’t forget to invest.

This is possible using the auto-invest feature, which makes it easy to stay consistent, even when you forget.

Set a funding amount, frequency, and payment method, and Rise will automatically fund your investment on schedule.

With Risevest, you achieve your financial goals faster. Save for school, home, vacations, children’s future, and more.

The possibilities of what you can achieve with Risevest are limitless, which you will discover when you start using the app.

Risevest Features

Here, we will be going through Risevest features so that you can know what to expect exactly.

1. Stocks

Risevest helps you invest and manage your money by investing in a portfolio of 30 high-growth stocks across the US market with an equity portfolio of power stocks.

Risevest carefully selects the strongest and best-performing stocks that expert US hedge funds and fund managers buy every quarter.

The fintech company will then research those stocks based on critical factors such as growth rate, valuation, competitive advantage, and market rate before deciding.

After a thorough analysis, we add undervalued stocks with high potential to our stock index; then, we monitor the portfolio companies for growth.

Risevest keeps only the best-performing stocks in the index to make sure your investments grow steadily.

2. Real Estate

Risevest invests in its portfolio of rented buildings in the US and manages your money for returns through rent and capital appreciation.

This work is pretty simple.

The Risevest team buys or rents high-demand properties in the US below market value to ensure profitable investments.

After that, they rent or sell those properties on the open US market and pay your returns.

Your money is secure, and it is on the safe side because the Risevest US properties are insured against loss, damage, and loss of rental income.

3. Fixed Income

The Risevest fixed income is a low-risk asset perfect for anyone who wants to protect their money in a secure, appreciating currency. E.g., dollar.

Investing in fixed income is like having a fixed deposit in another currency (USD).

Here, you can either invest your funds for a short time or a long time.

The duration ranges from 3, 6, or 12 months calendar.

Funds are parked in a portfolio of sovereign dollar-denominated bonds with maximum safety.

Interest is paid at maturity in addition to the principal. Keep in mind that you can’t break your investment before maturity.

The Risevest app currently has over 200,000 people investing in loan term goals of fixed income.

4. Build Wealth

The Risevest build wealth is designed for those who want to save for retirement.

Here, you can calculate your current age and when you want to retire on the official website.

You also get to see the percentage of what you are getting as interest based on the years you have selected.

If you want to secure your future that is yet to come, then try the Risevest build wealth feature.

Read more: PiggyVest vs Opay-Which is better?

PiggyVest Overview

PiggyVest is a fintech company designed to help people save, invest and reach their financial goals faster.

The PiggyVest app was introduced in late 2016 when it was first name PiggyBank and later rebranded to PiggyVest.

And since its launch, it has been operating legitimately and has some excellent features in store.

As of the time of writing this content, PiggyVest has helped over 4 million users achieve their financial goals from the comfort of their bedrooms.

It is possible because PiggyVest offers its users a wide range of savings options.

And anybody from anywhere in the world can permanently save with PiggyVest.

That is because you can save with PiggyVest for as low as N500, which makes it available to the masses.

And as little as N2500 for the investment listed on the platform.

The investments are like a share, so you only buy based on your financial capability.

You can also own properties when you invest in real estate businesses listed on the platform.

You can own a piece of land or an apartment in a building.

Having an apartment in a building means you can collect a yearly rental income, which I love.

In addition, security is of the utmost priority of the platform, which means that your data and your money are safe on the platform.

These and more have gotten PiggyVest featured on many reputable online platforms.

What you can do with PiggyBest regarding savings and investment is limitless; you just need to find your unique angle.

Learn more: Is PiggyVest legit?

PiggyVest Features

Let’s go through the PiggyVest features.

1. Flex Naira

The Flex Nair is a product designed to help you receive and withdraw naira at any time.

You can also see the Flex Naira account like your savings account, which you can always save and withdraw from at any time.

With a Flex Naira account, you can save for emergency days and be able to withdraw at any point in time.

One of its advantages is that by allowing your money to sit down in your Flex Naira account, you will get up to an 8% interest rate annually.

2. PiggyBank

PiggyVest was formerly called PiggyBank. This feature remains the primary function of the app.

You can save and withdraw money at any point in time without any restrictions.

Your savings and withdrawals can be daily, weekly, or quarterly. All are compatible with this savings feature.

If you are a beginner looking for one to start with, this would be fine.

3. Safelock

Safelock, as the name implies, is like a fixed deposit account that warrants you to save money in your savings account within a specific period.

The money that you save here isn’t withdrawable until the maturity date.

If you need the money urgently and want to break your agreement, a penalty fee of 2% is applied to you.

This is put in place to encourage discipline among the savers and also the money you pay them as being used for other business purposes.

You are entitled to an upfront 12.5% interest payment when you commit to the savings plan here.

4. Flex Dollar

The Flex Dollar account is designed to help you save money from inflation or other reasons that are best known to the owner of the funds.

All your transactions are in dollars, including save, invest, send, or withdrawals.

You can also transfer money from your Flex Dollar account to advance countries of the world like the USA and the like.

You are entitled to up to 10% annual returns for saving money in your flex dollar account.

Risevest vs. PiggyVest: Key Differences

Let us go through both apps’ differences.

- Risevest deals with dollars, while the significant currency of PiggyVest is the Naira.

- Risevest primary market is the USA, while PiggyVest’s market is Africa.

- Risevest deals with Stocks, while PiggyVest doesn’t.

- Risevest invests directly in real estate businesses, while PiggyVest serves as an escrow between its users and business owners.

Risevest vs. PiggyVest: Reviews

Let’s go through what existing users of both platforms are saying about them.

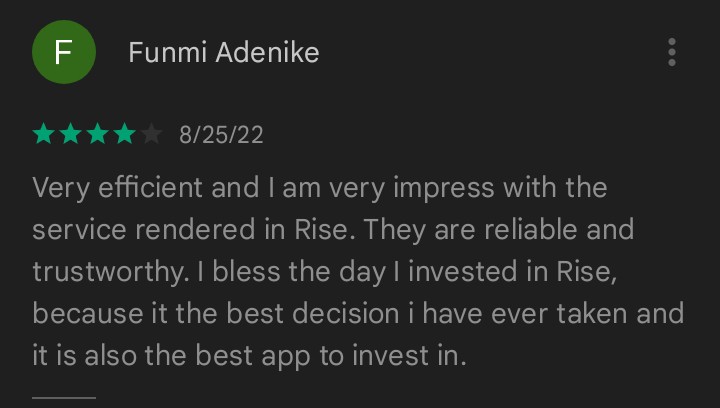

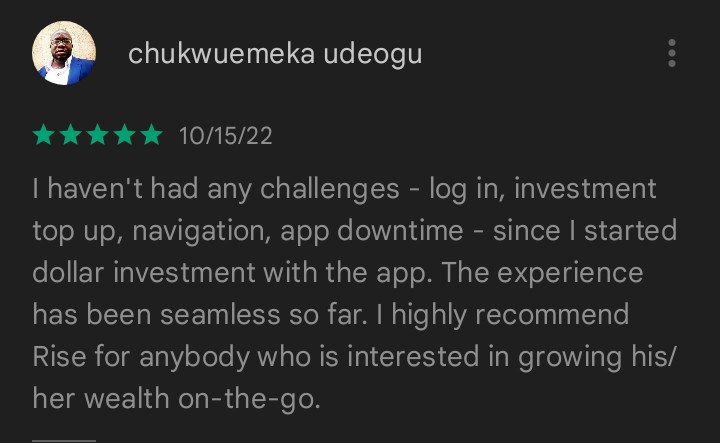

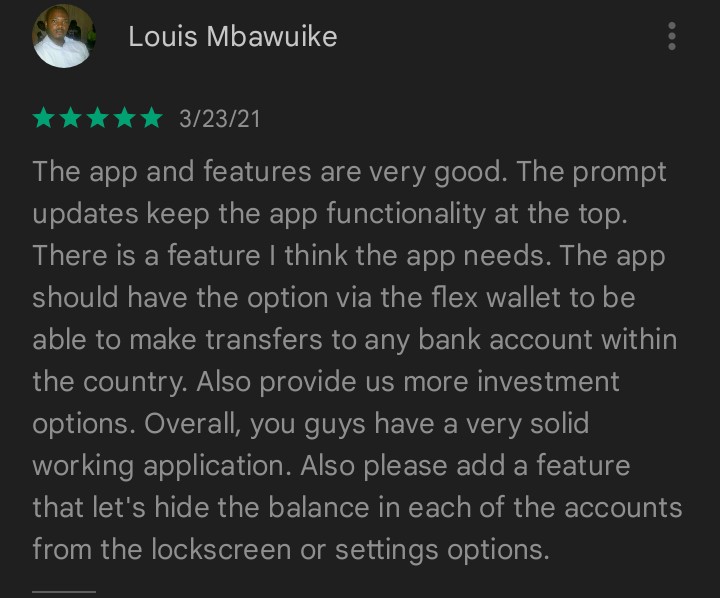

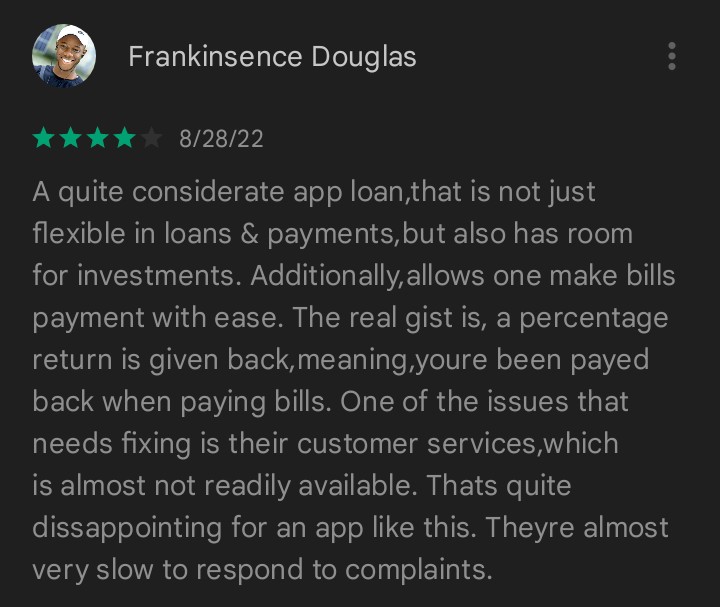

Risevest Reviews

When writing this content, Risevest has an overall rating of 3.7 out of 5 and over 2,000 reviews.

Let’s take a look at what users are saying.

PiggyVest Reviews

PiggyVest has over 43,000 reviews and an overall rating of 4.1 out of 5.

Let’s take a look at what people are saying.

Risevest vs. PiggyVest: Pros & Cons

Here, we will look at the pros and cons of Risevest vs. PiggyVest.

Risevest Pros & Cons

Here, we will be looking at the pros and cons of Risevest.

Risevest Pros

- Invest in a stable currency that appreciates more over time.

- Easily invest in US stocks right from your home country.

- Build wealth over time by saving towards your retirement.

- High returns on your investments.

- You choose what is best for you, from US stock, real estate, fixed income, etc.

Risevest Cons

- The Risevest application is unstable.

- Customer service is poor.

PiggyVest Pros & Cons

Here, we will be looking at the pros and cons of PIggyVest.

PiggyVest Pros

- Flexible and easy savings for all categories of people.

- Access your money anytime on some of PiggyVest products.

- Excellent and reliable investment opportunities.

- Earn good returns on all of your savings.

- You can easily grow wealth over time.

PiggyVest Cons

- A 5% service charge is applied when you break your savings before maturity.

Frequently Asked Questions

We will run through the frequently asked questions we often get from our blog users.

1. Risevest vs. PiggyVest: Which is Better?

Both platforms are excellent and good at what they do; the one you use will depend precisely on what you are trying to achieve.

2. Is Risevest registered with SEC?

Risevest is registered with the U.S. Securities and Exchange Commission (SEC).

3. Is PiggyVest approved by the CBN?

Risevest and PiggyVest are approved and regulated by the Central Bank of Nigeria (CBN).

4. RiseVest vs. PiggyVest: What is Minimum Investment?

You can invest as little as $10 on Risevest and as little as N500 on PiggyVest, making the platform accessible to everyone.

Final thoughts

Risevest and PiggyVest are both excellent platforms and are good at what they do.

The one that you use will depend on your goals, and goals vary depending on everyone’s beliefs.

Suppose you are looking for a reliable, safe, and trustworthy savings and investment platform within your money country, In that case, PiggyVest is cool because it has a savings option that fits all categories of users.

If you are looking to go internationally, on the other hand, by making all your investments based on dollars, then Risevest is your go-to.

With that, we have come to the end of Risevest vs. PiggyVest. Do let me hear your comment section below.

![How to Open a Stripe Account in Moldova [Open & Verify]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-35-768x432.jpg)

![How to Open a Stripe Account in Greece [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-26-768x432.jpg)

![Is Renmoney Legit? [The Unbiased Truth]](https://smartbizfreedom.com/wp-content/uploads/2022/10/Is-Renmoney-legit.jpg)

![How to Open a Stripe Account in India [2023] – Works 100%](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-India.jpg)

![How to Open a Stripe Account in Oman [100% Legal]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-36-768x432.jpg)

Thanks???????? for the information it’s really encouraging

Thank you Mr. David.

This was helpful.