How To Open Stripe Account For Non-US Countries [Legally ⚠️]

The truth is, you can use Stripe for non-supported countries if it’s not allowed by default in your country and this of course is legal.

Stripe is the number one payment gateway you can use to receive or process payment online from your customers and from any part of the world.

Irrespective of the kind of business you’re running or trying to create, be it eCommerce, Booking Service, or Subscription Service.

Unlike other Payment gateway services, you can easily use Stripe to process your payment without going through any stress.

Stripe itself is free to use, however, they charge 2.9% + 0.30 cents for every successful payment made by your customers.

So technically, you can still add the charges to your product price and use the whole service for free.

The bad news however remains that stripe is not fully supported worldwide or it’s partially supported in some countries.

So if you need an unlimited stripe account to process payment online I want you to keep on reading.

You’ll learn how to use Stripe and as well as how to set it up without stress.

Requirements For Opening a Stripe Account For Non-US Countries

For you to set up a Stripe account legally without any future issue, you’ll need the following:

The most important of all is creating a Limited Liability Company (LLC) in the US in other for you to get your Tax ID (EIN).

Once you’ve gotten your EIN or Tax ID, you can then proceed to create your Stripe account.

Setting Up an LLC for Your Business in the US

One of the great advantages of having your business set up in the United States isn’t just for using Stripe. You can have multiple businesses under your registered business name in the US.

Also important is that you don’t have to have a Social Security Number (SSN) to set up your business in the US.

You just need to choose a business name and decide on the state where you want it registered. However, you need to be careful about which state you decide to set up your business entity.

This is because some states charge high state filing fee (Business Registration) and as well as annual business tax.

But I do find;

- Colorado

- New Mexico

to be quite affordable.

Colorado charges a $10 annual Tax fee and $50 state filing, while New Mexico charges a $50 state filing and $0 annual Tax fee.

The state annual tax is a tax you pay on your business at the end of every year. So, they vary based on the state you choose to set up your business.

States like California and Hawaii should be out of your pick because they are freaking high on tax.

But not to worry, the sole purpose of this post is to show you how to get it done as easily as possible and at the cheapest fee.

I’m equally not based in the US, and I have my business set up there, so I can easily use Stripe in country.

I was able to do this using Northwest Registered Agent and New Mexico as my business state because they’re relatively cheap.

The good news is I’ve been able to partner with them because I know many people will be needing this service and I want them to have it at the best place.

Plus, there are various services out there charging as high as 500 – $1000 for this same purpose.

A good example is Stripe Atlas. But at the end of this post, I’ll show you how you can get it done for less than $290.

Coming from someone who’s also living in a country where stripe is not enabled, I know how beneficial it can be for your online business.

How to Form Your Business LLC in USA Using Northwest Registered Agent

To be able to use Stripe to process payment as a non-US resident you do have to form a business entity in the US using Northwest Registered Agent.

Northwest Registered Agent offers online business incorporation services, as well as additional business services such as record books, operating agreements, federal tax identification numbers, etc.

I did intensive research before finally picking Northwest Registered Agent for my business LLC formation in the US. Their service was on point, and I was moved to partner with them to share with you guys.

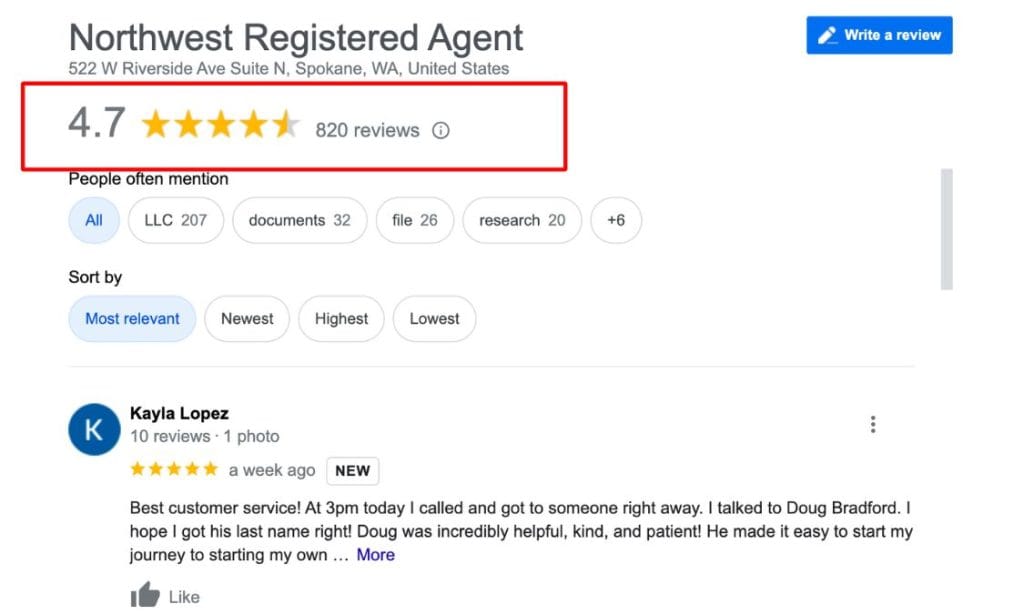

Going through their reviews on Google reviews should show you exactly what I’m talking about; they are simply the best out there.

Now let’s proceed to form your LLC at Northwest Registered Agent:

Setting up your LLC with Northwest Registered Agent is really straightforward; I’ve broken it down into the step-by-step guide below.

All you need do is follow the steps, and your LCC and Tax ID will be set up.

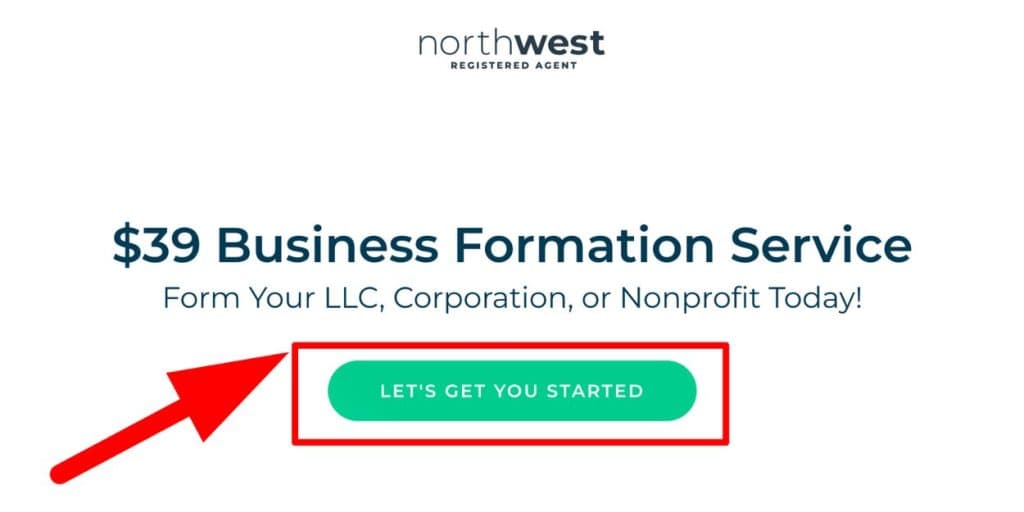

Step 1. Head Over to Northwest Registered Agent

First, you need to head to Northwest Registered Agent to get started. Upon getting to the web page, click on the “Let’s Get You Started” button…

The next page is your business entity type and the state you want to form the LLC.

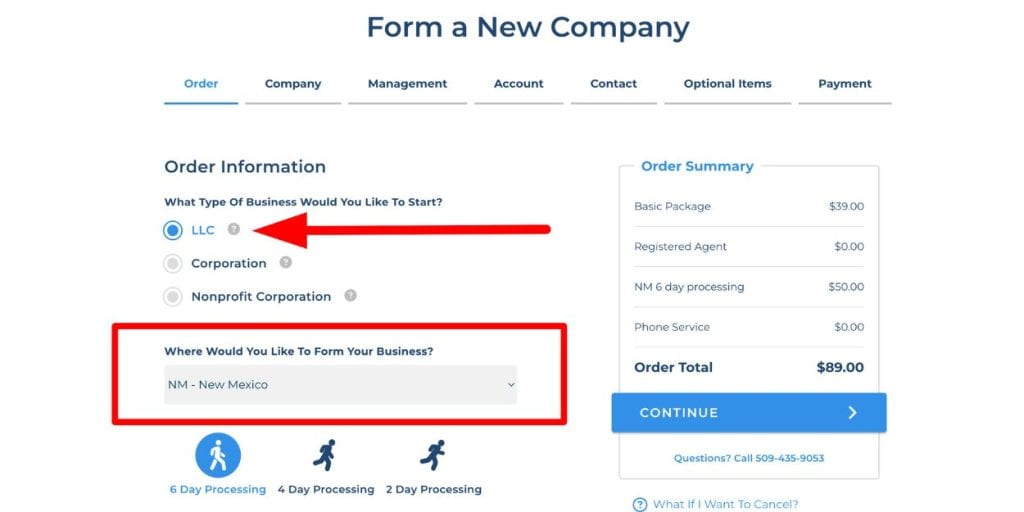

Step 2. Choose Your Business Entity and State

Simply choose LLC (Limited Liability Company) from the drop-down menu and choose your state. You can go with New Mexico because of the low cost and the free annual tax fee.

The business formation fee itself is $39, and the state fee for New Mexico is $50 as you can see from the image above.

You can also see the option of spending it up below the state. The opt 6 days, 4 days, and 2 days processing for your business formation.

After that, click on “Continue”

Step 3. Enter Your Companies Information

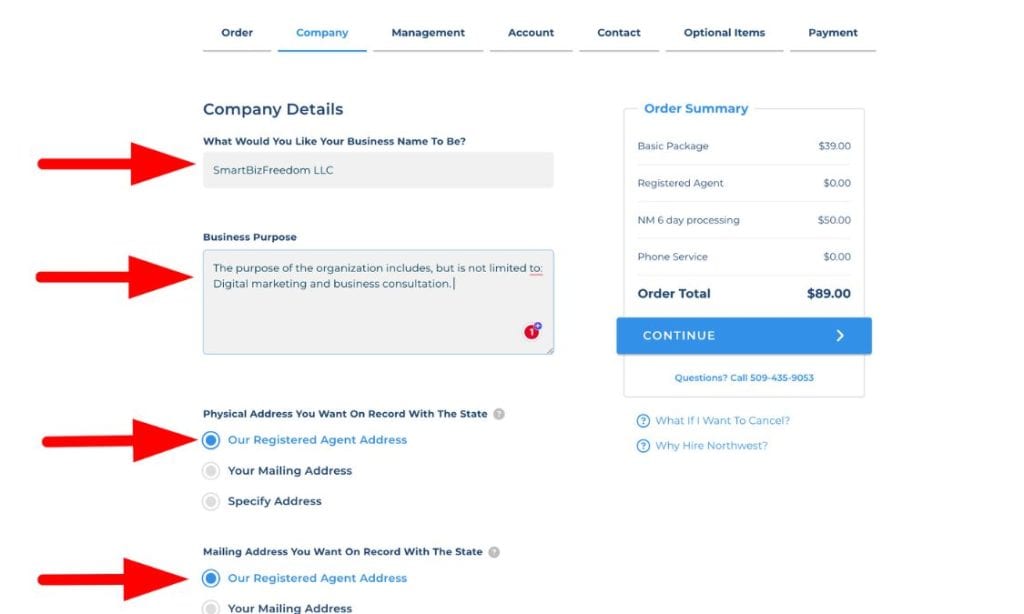

As I said earlier, you’ll need to pick a name for your business and a search will be carried out on it to check if it’s still available.

Your business name will be created immediately upon state approval if it’s available. However, in the case where your proposed business name is not available, you’ll need to adjust the name or find another one.

But it’s not going to cost you any additional fee!

What you need to do here is enter your proposed business name, A good example is Smartbizfreedom LLC and also write a short description of the business.

Another good option for using a Northwest registered agent is the fact that you don’t have to bother about a US address for your company.

Northwest registered agent gives you the option to use their address as your business address. Some other agents require you to rent a virtual address for this.

But with Northwest Registered Agent, it won’t cost you extra money. For the mailing, you could also use them only if you don’t have a mailing address option.

If you want your physical documents, add a US mailing address for this option.

Step 3. Enter Management For Your Company

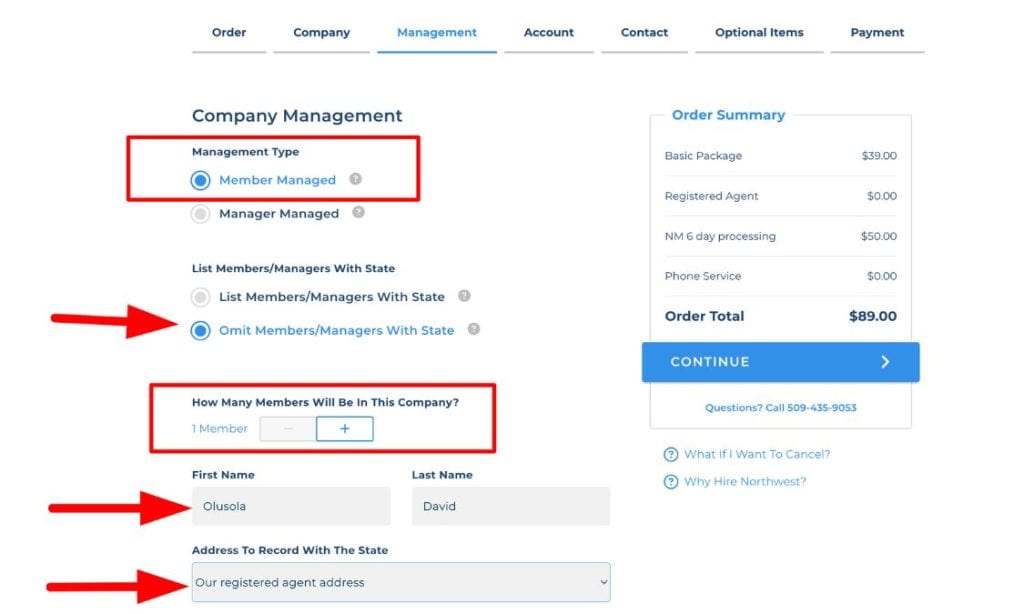

The next step is about the business owner. At this stage, you’ll need to if the business is member-managed or manager-managed.

Next, tick the “Omit Members/Manager with the state, which will keep your business details private from the state you’re forming it.

After that, indicate how many members will be in the company.

Since it’s a single-man business, you can leave it at one member and then enter your name as you can see mine from the image above.

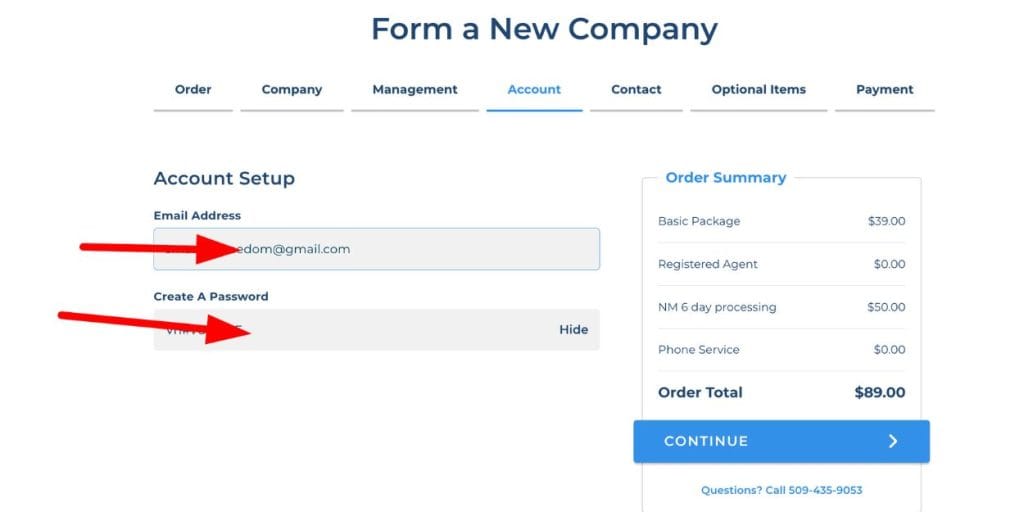

Step 4: Create an Account with Northwest Registered Agent

At this stage, you need to create an account with Northwest registered agent so you can manage your business from their dashboard.

As you can see from the image above, enter your email address and create a password for logging in to your Northwest registered agent account.

After that, click the continue button.

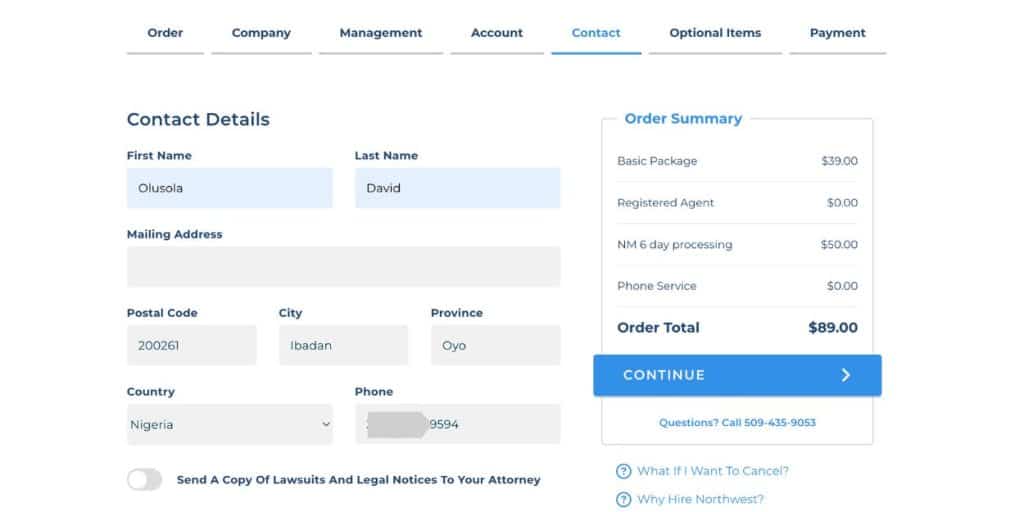

The next thing you want to do is enter your contact details, which will be your contact details for Northwest Registered Agent.

So make sure it is your original details and the country you’re living in.

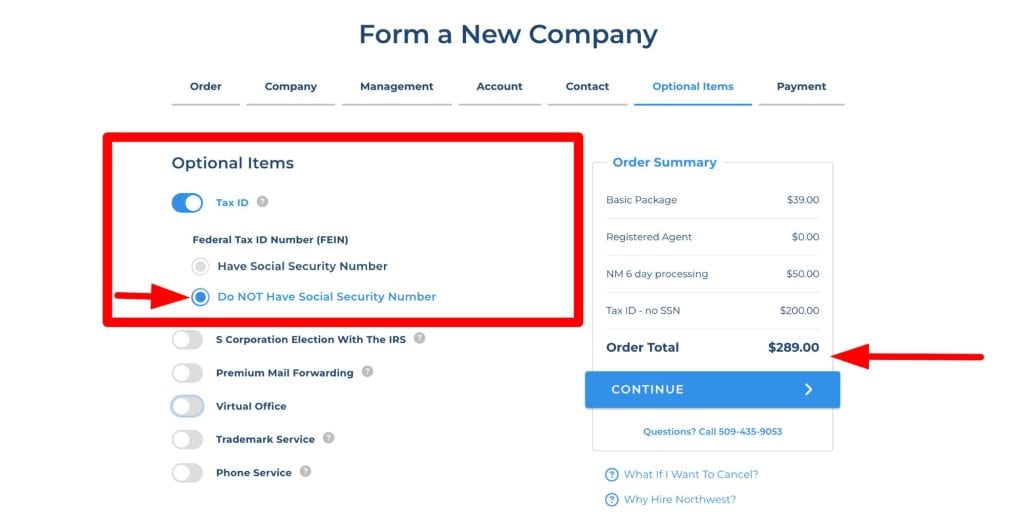

Step 5: Getting Your Tax ID (EIN)

Northwest registered agents will get your EIN or Tax ID for just $200 if you don’t have an SSN or you’re a foreign entity, which is relatively cheap compared to other services out there that may look cheap but have hidden charges.

Northwest is 100% transparent about all the money you’ll be paying.

So you’ll only pick the Tax ID here; other things are additional upsell. For the phone service, I did a video on how to get one at an affordable price.

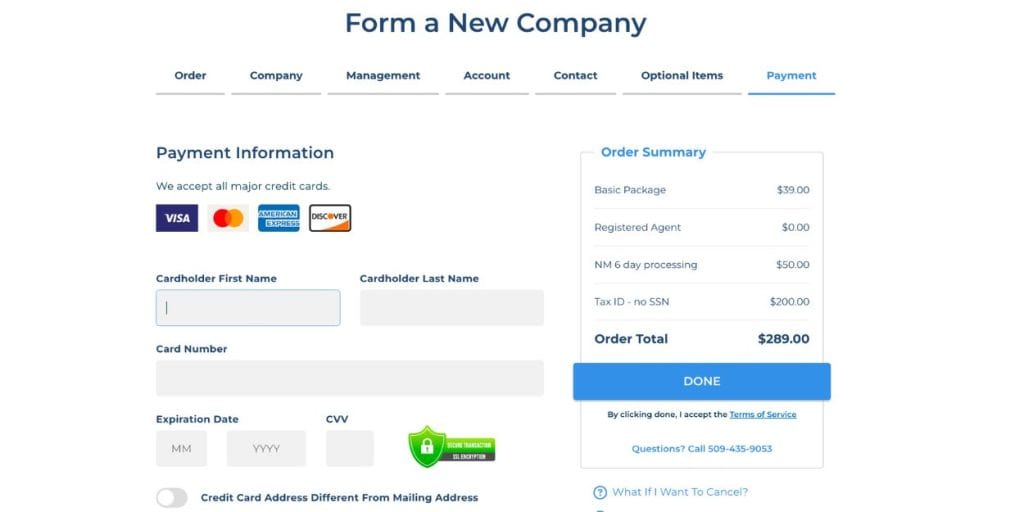

Step 6. Pay and Checkout

The last thing left here is to enter your card details, make the payment for your business registration, and get your EIN as soon as possible.

Frequently Ask Questions

Below are some of the most frequently asked questions about business formation with Northwest Registered Agent.

Opening a US Bank Account with Payoneer

This is very much easy since we have Payoneer for that. All you need to do is register with Payoneer.com, connect with Global payment service and you’ll be able to get your virtual US bank account.

Once this is done, you can now have your funds move from Stripe to Payoneer and cash it in your local currencies. It’s as easy as that.

However, to do this, you do need to access your Stripe account.

From your account, you can proceed to the payout sections and add your Payoneer account number and that’s it, you’re all set up.

You are now a proud owner of a business in the US plus you also have a bank account. Isn’t that cool?

How To Open Your Stripe Account to Process Payments Online

Once your business LLC is registered, your business will equally receive a tax ID or EIN. Which is part of what we need to create your Stripe account.

So here, I’ll walk you through the process of opening your Stripe account start receiving payments from your customers.

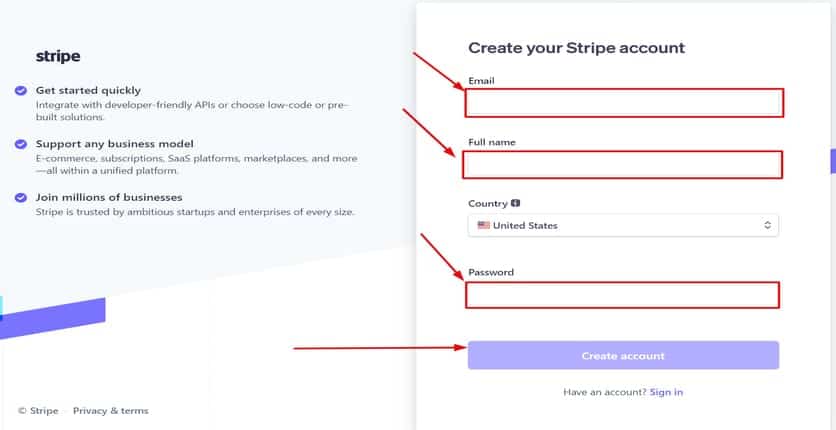

To create your Stripe account, simply head over to https://dashboard.stripe.com/register and create your account.

Enter your email address and full name and choose your country of business formation, which in our case is the United States.

After that, Stripe is going to send you an email prompting you to confirm your email address.

Once you receive the email, confirm it and proceed to activate your account.

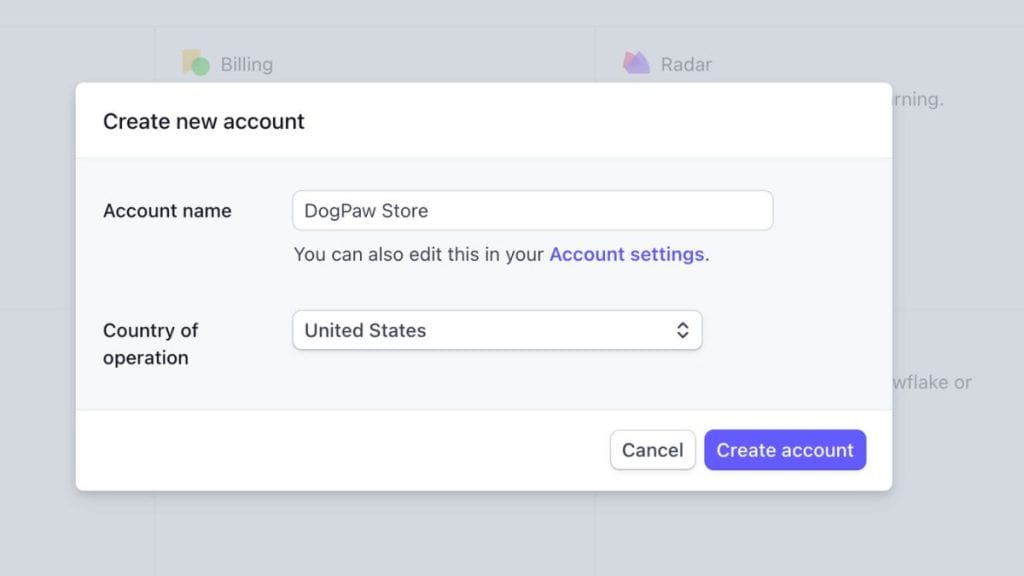

Step #1: Name Your Stripe Account

You can create your account under the name of the website you want to use Stripe to receive payment.

The next page will ask you to enter your business name, that is, the business you registered in the US.

Another good thing about Stripe is that you can create multiple sub-accounts, meaning if you have another website, you can create another sub-account for it.

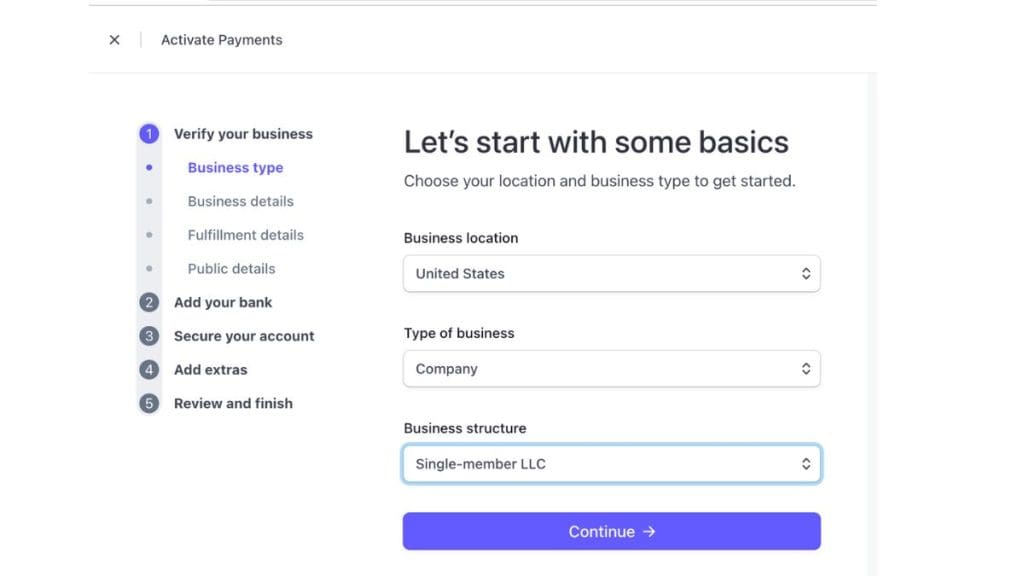

Step 3: Choose Your Business Type

This is where you’ll enter your registered business details for you to create your Stripe account with it.

Choose your business location as US, your type of business as Company, and finally, choose your business structure.

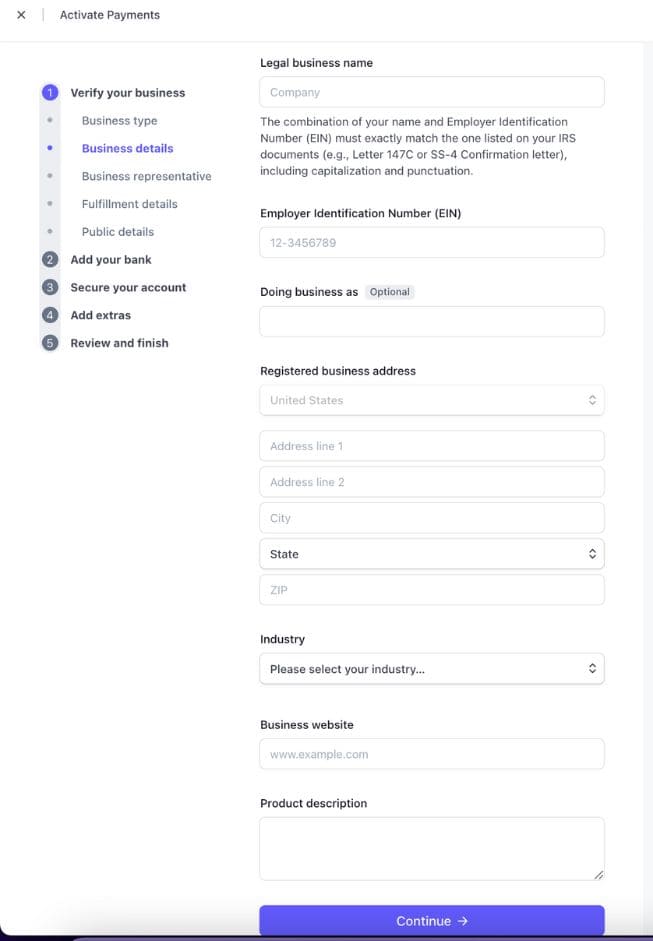

Step 4: Enter Your Business Details

As you can see from the image above, enter your registered business name and the EIN you receive from Northwest Registered Agent after forming your business in the US.

After that, enter your business address in the US. You can use the one given to you by the Northwest Registered Agent.

Next, choose your business industry and enter your website, then finally, a summary of what you’re selling.

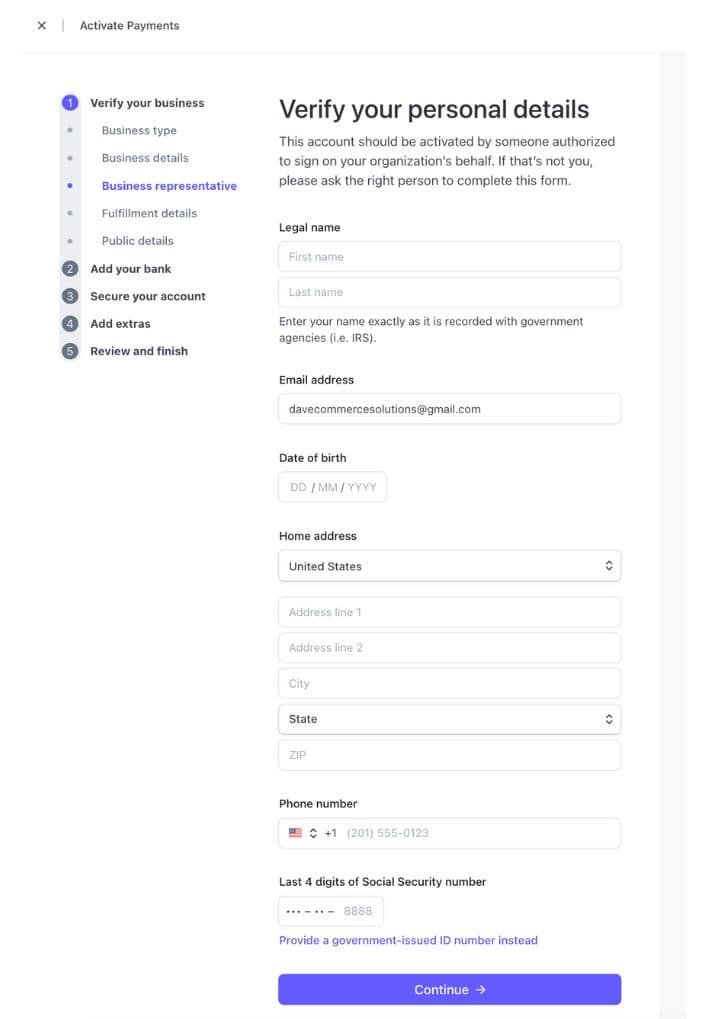

Step 5: Enter Your Personal Details

At this step, you’re going to add your own personal details. Enter your first name and last name, email address, and your date of birth.

At the home address section, click the drop-down menu and select your country. Once you’ve selected your country, enter your address.

Make sure the address is the same as you have on your ID because you’ll need to upload your ID for verification.

For the phone number section here, you can enter your number. To do that, click the drop-down menu and choose your country.

For the (SSN) Social Security Number, select “Provide a government-issued ID number instead.“

Once you’ve clicked on it, choose your country and enter your government-issued ID number.

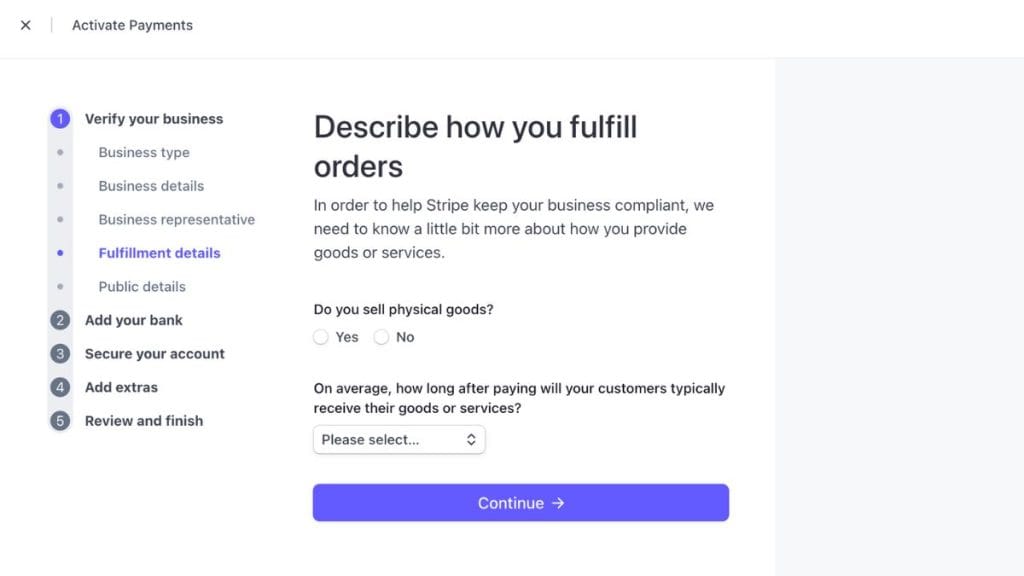

Step 6: Choose Your Product Type

At this step, choose the kind of product you’re selling, whether it’s digital goods or physical goods.

After that, choose how long it will take your customer to receive the product.

Step 7: Other Things To Do…

- Add Your Bank Details: Use the US bank account from Payoneer, Wise, or Mercury.

- Secure Your Account: Add a 2-step authenticator to secure your Stripe account.

Finally, review and finish your account by clicking submit. After you’ve submitted, you’ll see a prompt to upload your ID for Stripe to verify your account.

Upload your Country ID to get your account verified and activated.

Now go to your dashboard, and you’ll see that your verification status is currently being reviewed.

So at this stage, your account should be approved in no time so far what you’ve provided are all the correct details.

Stripe For Non-US FAQ

Conclusion

With the above formation, you can now receive payment twice as you used to.

Your business is also fully legalized in the US in a real place and real state. I hope you find this very helpful.

What are your thoughts on this? Let me know them using the comment box!

![How to Open a Stripe Account in Serbia [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-33-1-768x432.jpg)

![How to Open a Stripe Account in Bhutan [100% Full Guide]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-3-768x432.jpg)

![How to Open a Stripe Account in Albania [Open and Verify]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-33-768x432.jpg)

![Is Lidya Legit? [What You Need To Know]](https://smartbizfreedom.com/wp-content/uploads/2022/10/Is-Lidya-legit.jpg)

![How to Open a Stripe Account in Kazakhstan [Step by Step]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-13-768x432.jpg)