How To Download Branch Loan Mobile App For iPhone or Android

In this article, we’re going to learn how to download Branch loan mobile app.

The Branch Loan mobile app is worth considering if you’re looking for an easy and convenient way to get a loan or borrow money.

It allows borrowers to access loans from their mobile devices at their convenience easily. So, if you’re looking for an easy and convenient way to get a loan or borrow money, then ensure that you stick around to the very end to know how to download the Branch mobile app on your mobile devices.

How to download the Branch loan app for Android

Let’s quickly learn the step-by-step approach to downloading the Branch loan app on an android device.

Visit the Google play store

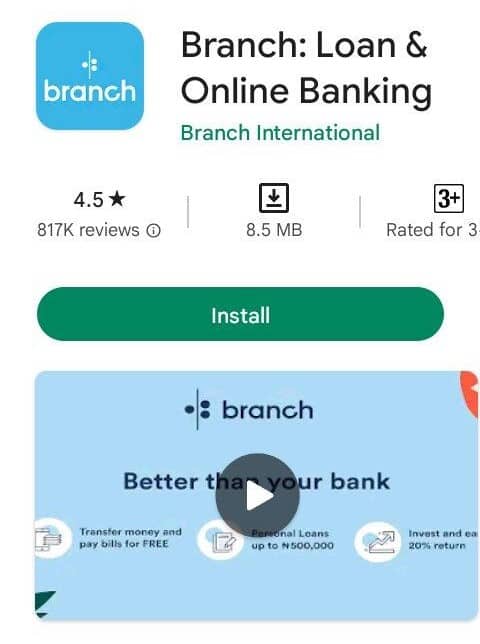

To download the branch loan app on your android, head over to the google play store on your android phone. It is currently available for android users of version 5 and above and has over 10 million downloads and 800k+ reviews from users.

Search for Branch loan mobile app

Hit the search bar, and type out Branch loan mobile app. When the search result comes up, click on it.

Install the app

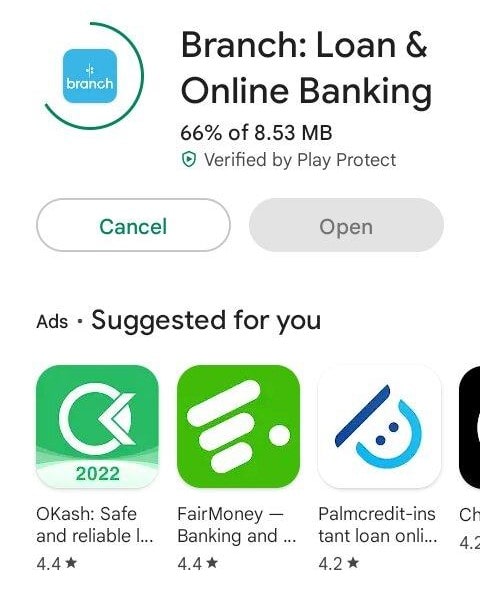

After you’ve confirmed that it is the app, click on Install. Once the installation process is complete, open the app on your device.

Register an account

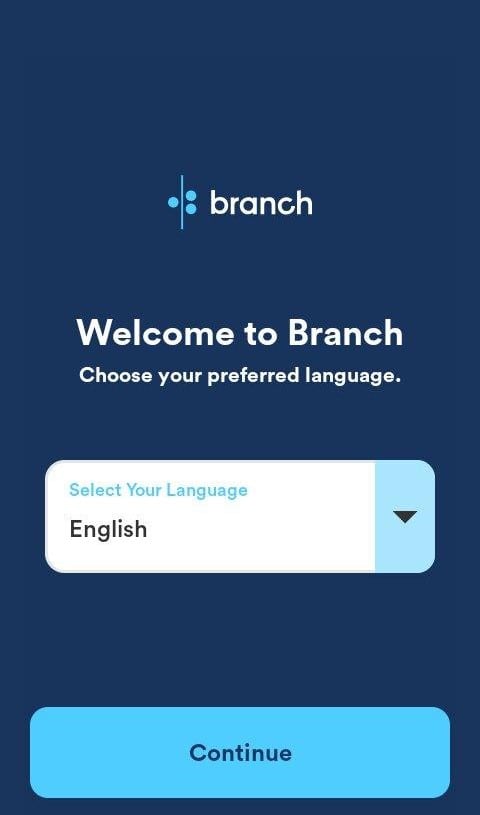

You will be asked to select your language on opening the app for the first time. We will choose English. You then click on Continue.

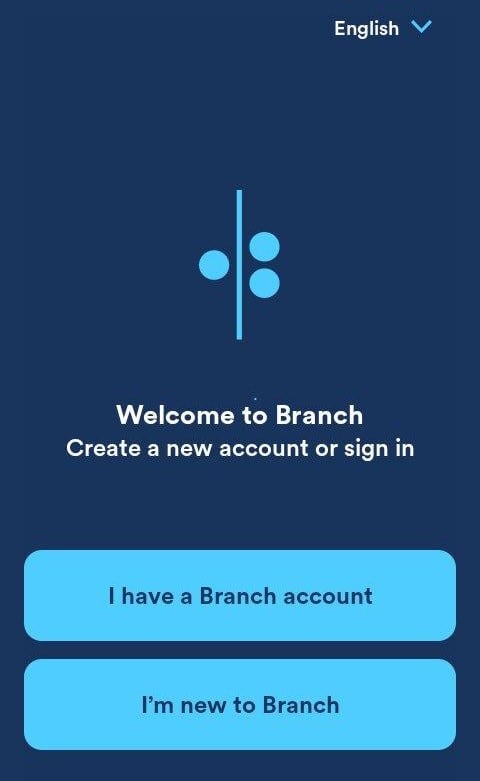

Choose the “I’m new to branch option”.

Then you can choose to learn more about the app or simply go straight ahead to create your account. Since you are creating an account, choose – “Take me to Sign in / Register”.

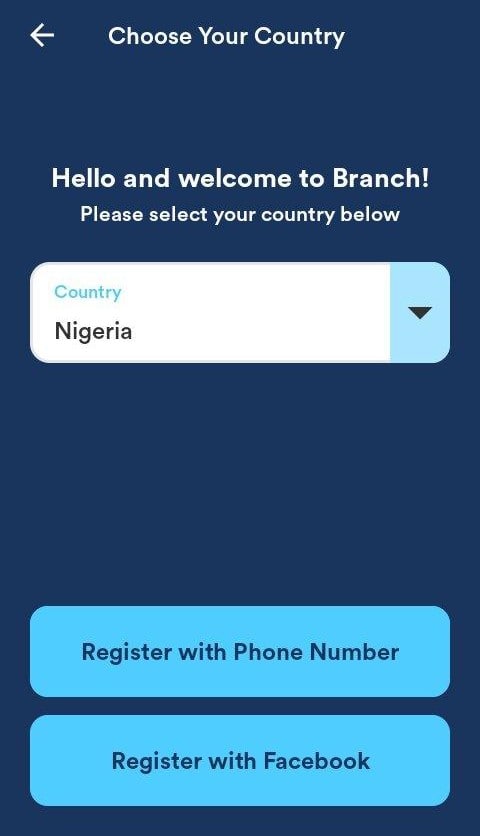

Select your country, and then you can choose to register with your phone number or with Facebook.

If you choose your phone number, you will be asked to fill it in the space provided. An example is shown below.

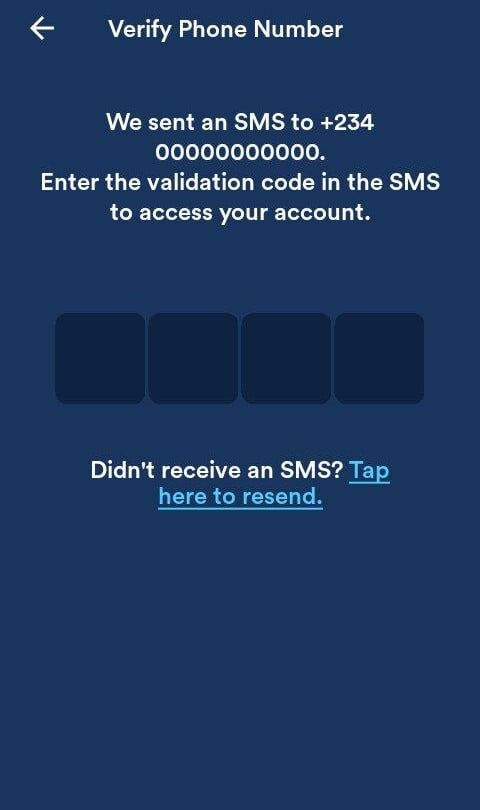

A verification code will then be sent to ensure that it is your phone number.

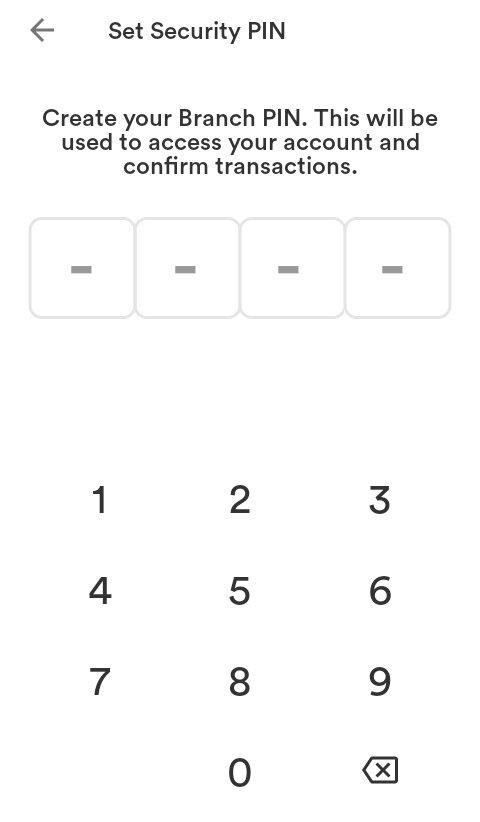

After completing the verification, you will be prompted to create a pin for all your transactions.

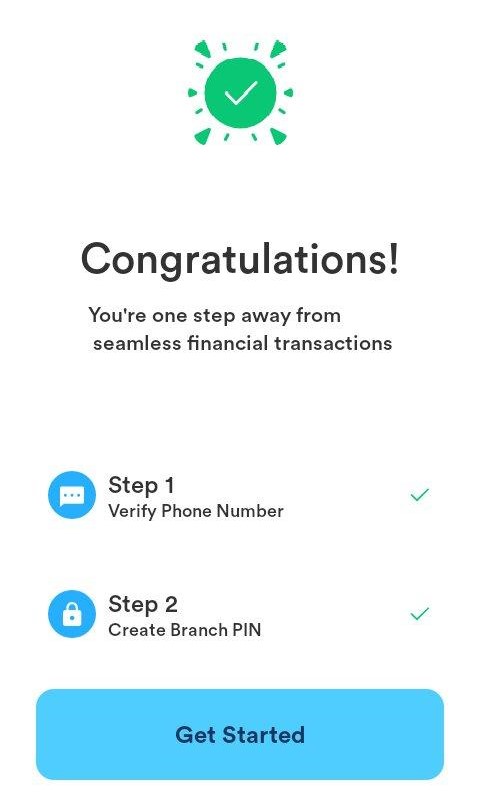

Create your PIN and click “Get Started” as shown below:

You can now add funds, apply for funds or invest. In addition, you can also earn rewards on the app.

Once registered, you can view your account history, make loan requests, invest your funds, and track your repayment progress. To access all app features, you must link your account with your BVN (Bank Verification Number).

How to download the Branch loan app for iPhone

For iPhone users, the branch loan app is currently unavailable on the app store. If you use an iPhone, ensure that you check at regular intervals on the app store for any updates. It should be available on the app store very soon.

Essential Features of the Branch Loan Mobile App

The Branch loan app has lots of exciting features that make it one of the most downloaded micro-loan lending apps on Google Playstore.

Beautiful User Interface

When you need to borrow money, the Branch Loan mobile app is the perfect tool for you. It has an easy-to-use interface that makes borrowing money fast and easy. You get money when you need it, not when it is available.

Customer Support

You can also contact customer service with any questions or issues that you may have right from the mobile app. The Branch Loan mobile app is available for iPhone and Android, so it’s perfect for anyone who wants to borrow money quickly and easily!

Instant Option Loans

The best feature offered by the Branch loan App! You can easily access loans immediately when you need money. The instant option is available to registered users, and your eligibility is determined by the platform using a set of rules and requirements. This feature usually attracts a maximum fee of $5 whenever you use the service to request loans. It is currently the most sought-after service on the platform due to its easy accessibility.

Standard advance

This feature is available to all registered users on the platform and does not charge extra fees. This option allows you to request money at any time you might be in need. The instant option might be the best fit if you want an instant loan.

Pay Your Bills

You can use the Branch loan app to pay for your airtime, data, electricity, and DSTV subscription. With your available funds, you can make payments from your wallet. Ensure your account has enough funds to pay your bills; otherwise, you can choose to fund your wallet from a bank account. As a bonus, 2% of the total amount is paid back to you!

Invest your funds

You can also choose to invest your funds on the Branch mobile app. The platform offers users two investment options; A Fixed investment and a Flexi investment.

The fixed investment option offers users 20% interest per annum when they lock their savings for a minimum of thirty days. You can also create multiple fixed investments with different maturity dates and earn interest on them. Users of this type of investment cannot access their money before the thirty days minimum has elapsed.

On the other hand, the Flexi investment option offers its users a lower interest amount of 15% per annum. It is a flexible type of savings where users can easily access their funds whenever necessary. This option also offers users a weekly compounded interest, meaning you earn interest on your interest + savings.

Pros of the Branch loan app

Having learned how to download the Branch loan mobile app, let’s examine some pros of the Branch loan app.

Quick Loans

The Branch Loan mobile app is an excellent option if you’re looking for a convenient and easy way to get a loan. It has features like – a live instant option to request immediate loans for pressing needs and emergencies and a standard advance option for non-emergency loan seekers. Your requested loans are sent instantly to your bank accounts without any delay, and you can access money whenever you are in dire need of it.

Responsive Customer support

The branch loan customer support is available 24/7 to answer any questions you might have or to address any issues you might be facing or have encountered in the course of using the app. A most recent feature added to customer support is a video consultation, which makes it easy to get help from a representative whenever you might need help.

Responsive Interface

The app has an easy-to-use interface. The app is free of glitches or the usual slowness associated with cash apps. Every feature is well-detailed, so you do not have to waste your time searching for anything.

Little to no interest/charges

Interests are dependent on the customer’s risk profile and the amount requested. The interests charged are usually within the range of 17-40%.

Therefore, it is an excellent option for borrowers who do not want to pay high-interest rates on loans. So, whether you’re looking to buy a car, fix your home, or start a business, the Branch Loan app can get you the financial help you need anytime.

Free Bank Transfers

Users of the app can make two free transfers to any bank in one month. With this option, users can avoid paying other banks’ service fees on such transfers. A minimal fee of N10 is charged for the third and subsequent transfers.

Cons of the Branch loan app

The Branch Loan app is one of small business owners’ most popular mobile app options. Though it provides a quick and easy way to get loans for various purposes, there are a few limitations and disadvantages you should be aware of, some of which are;

Interests can accumulate quickly.

Fees can add up quickly if you’re not careful, so compare rates before signing up for a loan. You must compare the different rates because signing up for any loan whose rates you might not be able to afford might cause you to get heavily in debt.

Frequently Asked Questions

Can I use the Branch Loan mobile app online to apply for a loan?

Yes, you can use the Branch Loan mobile app to apply for a loan online. The mobile app is designed to make applying for a loan easy.

What are some of the most popular features of the Branch Loan mobile app?

Some of the most popular features of the Branch Loan mobile app include:

-Quick loans: With the branch loan app, you can quickly request loans and receive it in your account immediately.

– Being able to see your account balance: Knowing your current account balance helps you stay on top of your money and helps you to make sure that you’re always aware of where your funds are.

– Borrowing money: You can borrow money from friends and family in minutes with the app.

– Checking payments: You can easily see payments that have been made or are scheduled to be made. All these features make it easy for you to manage your finances and access them whenever and wherever you need them.

Is there a fee associated with using the Branch Loan mobile app?

No fee is associated with using the Branch loan mobile app. It is free to use.

What should I do if I experience any problems downloading or installing the Branch Loan mobile app?

If you’re having trouble downloading or installing the Branch Loan mobile app, try restarting your phone or tablet. Also, ensure you have a good internet connection. If these tips don’t work, please feel free to reach out to customer support and report your issue to them.

Conclusion

Now you’ve learned how to download the Branch Loan mobile app for iPhone and Android, it’s time to take advantage of its benefits. With the app, you can manage your account, track your loan progress, and stay updated on offers and deals from your bank. Download it immediately and have more cash in hand to either take care of your emergencies or various online business.

This brings us to the end of the article, if you have any questions, kindly leave them in the comment section below.

![How to Open a Stripe Account in Georgia [Working Tutorial]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-32-768x432.jpg)

![How to Open a Stripe Account in Nepal [100% Full Guide]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-768x432.jpg)

![What is Piggyvest? [Everything You Need To Know]](https://smartbizfreedom.com/wp-content/uploads/2022/10/what-is-piggyvest-768x362.jpg)

![How to Open a Stripe Account in UAE [New Working Tutorial]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-22-768x432.jpg)

![How to Open a Stripe Account in Jamaica [100% Easy to Open]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-43-768x432.jpg)

![10+ Apps Similar To PalmPay in Nigeria [Ultimate List]](https://smartbizfreedom.com/wp-content/uploads/2022/10/Apps-similar-to-PalmPay.jpg)