How to Invest in Cryptocurrency in Nigeria [Passive Income]

In today’s post, you’re going to learn how to invest in cryptocurrency in Nigeria and keep smiling to the bank for the rest of the year.

The truth is if you ask any kid what bitcoin is?

They will tell you they know it, even though they don’t know how it works. This is just to let us know the popularity of bitcoin nowadays.

Sincerely if anybody were to come and meet you 4-5 year ago and offer you an opportunity to invest in Bitcoin, I’m sure the majority of us will reject that offer.

Why? Because the majority don’t know how promising it was back then.

However, I’m sure you won’t want to repeat the same mistake again.

That’s the more reason I’ve come up with this article on how to invest and make money with cryptocurrency in Nigeria.

With the current surge in bitcoin in Nigeria you can invest as low as N10,000 and cash out N200,000 within a few months if you choose to invest in the right altcoin.

I personally invested in some cryptocurrency in Nigeria that cost me less than N20,000 as at the time but worth over N500,000 now in my wallet.

What was the trick? Just read on. I’ll share them with you in a giffy.

But before that, we need to understand what cryptocurrency is and how it works before actually investing in it.

What Is Cryptocurrency?

Simply put, cryptocurrencies are virtual money that can be used to purchase goods and services online, just like fiat currency e.g NGN, USD etc.

The difference is that cryptocurrencies don’t have a physical coin or paper and they’re not created by any central authority.

In order for someone to create digital coins in the same way as regular currencies, it requires difficult mathematical algorithms.

And which makes counterfeiting cryptocurrency nearly impossible without the knowledge of these calculations.

So as long as there’s internet access (and thus network connectivity), people will always have their own wallets on hand with information about how much cryptocoins you possess–something many authorities cannot monitor because transactions happen anonymously online among peers only!

However, for all of this to be successful there are three key ingredients that play the most important role. More on that later.

What is Bitcoin?

Bitcoin is a currency that was created in 2009. First of all cryptocurrency kind. It follows the ideas set out by an anonymous person who goes by “Satoshi Nakamoto.”

Unlike government-issued currencies, it’s operated without any centralized authority or banks and has lower transaction fees than traditional payment mechanisms online!

So basically it’s a type of digital currency (Also known as cryptocurrency). Which unlike most money, there are not any physical bitcoins that you can hold in your hand.

They only exist on the public ledger for everyone to see and verify transactions with their own computing power.

Bitcoin isn’t regulated by banks or governments so it has little value as an actual commodity but because of its popularity many other people have created new types of cryptocurrency collectively known as altcoins (most notably Ethereum).

What is Altcoins?

An altcoin is an abbreviation of “alternative coin” – it’s used as one term for any cryptocurrency other than bitcoin (e.g., LiteCoin, Tron, Ripple, Electroneum, etc.)

It can be hard to keep track of all these new types of digital currency available now but there are plenty out there worth looking into!

So basically they are a form of cryptocurrency different from Bitcoin.

Their characteristics differ from those of bitcoin and can include the way they create blocks or validate transactions, or provide additional capabilities like smart contracts for low-priced volatility.

Simply put, Altcoins are brothers and sister’s coins to the popular bitcoin. Bitcoin being the eldest in the family, all other cryptocurrencies (Altcoin) are the younger ones.

What Makes a Cryptocurrency?

Cryptocurrency itself isn’t controlled by a central authority but through a group of equally privileged participants that are all following set rules.

For Cryptocurrency to be successful, there are three key ingredients that made it be. And this includes.

- A Peer-to-Peer Network,

- Cryptography,

- And Consensus Mechanism

I know this may seem a little bit confusing, but don’t worry I’ll explain them in layman terms below.

#1. Peer2Peer Network

Unlike the common FIAT currency or local currencies like NGN, USD, and the likes, cryptocurrency doesn’t rely on any central bank authority to validate or facilitate any transaction made.

This means there’s no limit to the amount of cryptocurrency you can trade or have in your wallet or send and receive.

You won’t have to face any government policy as to how much money you can receive which is the case with FIAT currencies like Naira.

But instead, everything is validated and updated by a network of EQUALLY privileged participants in a shared ledger called BLOCKCHAIN.

#2. Cryptography

The second key ingredient being cryptography is the art of encrypting and decrypting messages to keep them secret from outsiders.

Now, this method is old as time. It can be used for anything from military communications during the time of war or ancient times when generals would use ciphers to relay encrypted messages back and forth.

This is used in cryptocurrency for the same reason. Mainly for peers to communicate securely in a hostile environment without interruption from a central authority.

#3. Consensus Mechanism

Since there are groups of participants ready to transact in the network or communicate securely. There’s a need to establish mutual rules that govern the process.

These rules are known as a protocol and they also include a consensus mechanism. This includes rules that regulate the access and updating blockchain transactions.

How to Invest in Cryptocurrency In Nigeria

As at the first time I’m writing this article I got a pop-up on my mobile phone that Bitcoin just hit $20,000 per coin.

ALAS… That’s around N7.3m in Nigeria Naira (2017).

Crazy isn’t it? Fast forward to 2021, Bitcoin is now over $50,000 (over N40m)

Now Let me burst your bubble even more!

Did you know that if you invest N10,000 in bitcoin 10yrs ago, by now, you’ll be worth over N1.5billion!

‘Aaamazing’!!!

Now, this is just to let you know the potential available in trading cryptocurrency in Nigeria. You might be thinking Bitcoin is too expensive now and it’s not within my reach anymore.

Well, that may be true, but there other means to this that the majority of the public don’t know about.

And I’m going to be sharing them with you now for FREE!

Bitcoin may be out of your reach financially but there are other cryptocurrencies popping up everyday at an extremely stupidly cheap price.

With coins like this, you can invest N10,000 and within a few months have your funds grow to N500,000 or more.

Not trying to Hype you here or sugarcoat anything. That’s just the truth of the matter. So your work will be to look for these coins and buy them at a very tender age.

Then sell them after a few months or years depending on how long you want to hold them or depending on their current value.

Just think of it as buying land, then selling it off after a few years later. The only difference in this is that crypto investment is a lot volatile (Risky) compared to real estate.

Now for this to be successful, you’re going to need a couple of things. And this includes

- Crypto Exchanges

- And Crypto Wallet

#1. Cryptocurrency Exchangers In Nigeria

Cryptocurrency exchanges are platforms that facilitate the buy and sell of cryptocurrency around the world. Like the popular bitcoin or Ethereum.

Take, for example, if you want to buy Ethereum in Nigeria, you’ll need to visit certain cryptocurrency exchangers in Nigeria.

From there, you can choose to pay for the Ethereum via credit card or bank transfer and have the equivalent amount of money transferred to your Ethereum wallet.

More on the wallet later.

However, due to the current ongoing cryptocurrency restriction in Nigeria, some crypto exchanges like Luno don’t currently sell and buy cryptos with Naira.

A few handfuls of them still support the naira and I’ll list the best two below.

Binance

Binance is the world’s largest crypto exchange, and it’s the top choice for buying and selling altcoins.

This crypto platform has an astonishing 1,400,000 transactions per second with 2 billion in average daily volume!

The founder Changpeng Zhao launched Binance Wayback in 2017 after realizing that China was not safe due to strict laws on cryptocurrencies at the time.

It relocated to Japan and now has its headquarter in Malta.

Binance supports the buying and selling of crypto with Naira via bank transfer through their peer-to-peer features.

This means that if you want to buy any cryptocurrency on Binance, the platform will match you with a seller that receives naira.

Once the transaction is complete the crypto equivalent will be deposited inside your Binance wallet.

Binance is a low-cost and diverse cryptocurrency exchange with hundreds of coins to choose from.

With BNB, the platform coin, you’ll get 50% off your trading fees if you use the native digital currency of Binance (BNB).

In essence, what this means is that you can use Binance to buy any cryptocurrency you want and save it for the future.

Roqque

ROQQU is another platform that lets you exchange crypto with Naira in Nigeria without having to worry about the crypto ban in Nigeria.

Being one of the biggest players on the crypto market in Nigeria with over 500k+ users in no time they’ve launched a decentralized means of trading that ultimately allows you to access your coins without breaching CBN directives.

The Roqqu platform is an excellent way for anyone who has cryptocurrencies and wants to trade them locally as they do not have any regulatory bodies controlling their transactions such as banks or other financial institutions.

The P2P network offers many advantages where there are none faced when using centralized systems.

It eliminates problems relating payments being refused due to expired credit cards or insufficient funds, theft by hackers among others

#2. Cryptocurrency Wallet

A crypto wallet is a software where bitcoin or cryptocurrency holders like me and you can store, receive and send bitcoin or other digital currencies that the wallet supports.

Think of it as the local bank account where you can save, send and receive money to.These Cryptocurrency wallets come in many forms.

It can be a downloadable application on your mobile phones, websites accessible via the Internet.

Or physical devices/hardware wallets (which looks like a USB stick) that you can have with you or keep in a secure place.

Since cryptocurrencies are digital currencies and physical currencies, they only exist and operate through the means of technology.

Thus, these can only be stored in digital wallets, which are also called cryptocurrency wallets.

So basically for you to successfully invest in cryptocurrency in Nigeria you need to have a wallet at which you’re going to save your coins.

Types of Crypto Wallet

Now that you know how a Bitcoin or crypto wallet works, it’s time to explore all the different types of wallets out there.

There are HOT and COLD wallets for crypto which we will now go over in detail.

Hot Wallets:

These work like your average digital bank account where they can be accessed from any device or computer at any time with an internet connection.

The only downside to this however is that if someone has access to your password they can have full control of your funds.

But when used correctly these offer some convenience when making payments or transacting online.

Example includes:

- Mobile App Wallet

- Web Wallets

- Desktop Wallets

Cold Wallets:

Cold wallets are ways to keep your coins offline, and away from hackers. These can be stored on USB keys or other accessible devices for easy access anytime you need them!

The best part? They’re much more secure than hot wallets.

They are perfect solutions for those who want to invest BIG in cryptocurrency because your funds and coin will be stored offline.

They don’t need a connection to the internet, so your coins are safe from hackers and thieves that lurk on online.

Cold storage can also be used by long-term investors or “HODLers.”

Examples includes:

- Hardware wallets

- Paper wallets

How To Make Money Money With Cryptocurrency In Nigeria

Now that we’ve understood everything about bitcoin and other altcoins (cryptocurrencies) the next thing is to look into how we can actually make money online from it in Nigeria.

Basically what you want to do is head over to Binance and look for these cheap altcoins then buy them and store them in your binance wallet.

Note: Before buying any coin even though it is extremely cheap you need to do your due research on the coin before actually investing in it.

Altcoins that are created with a specific value or with a definite purpose to solve a problem should be what you should invest in.

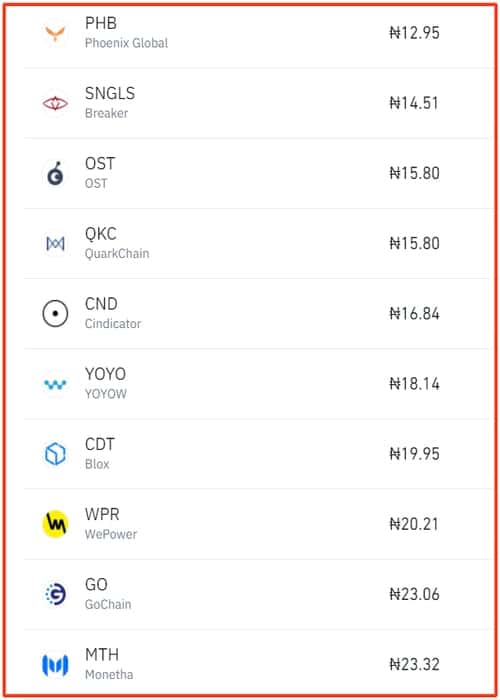

Now, as you can see from the image below, you’ll see there are several coins at ridiculously cheap prices that you can buy and keep on Binance for it to increase in price.

Do you know the best part? The majority of the cheap coins grows rapidly compared to the popular and established coins.

So with just N10,000 you can buy over 300 coins and watch it grow to the moon. So if you’re ready to start investing in cryptocurrency in Nigeria make sure to create your account with Binance.

It’s actually free of charge.

Things to Consider Before Investing In Cryptocurrency In Nigeria

First thing first, don’t get carried away with stories of investors making millions with cryptocurrencies.

Investing at an inopportune time can result in rapid and extreme losses if you’re not careful with your choices of assets you choose to invest in.

So you need to be careful and do your own research before investing your hard-earned money in any crypto asset.

Now for you to invest wisely in altcoins there are some key factors you need to take cognizance of. These factors includes:

#1. Coin Purpose

Crypto or coins created are like any other business project or startup. As we all know good businesses solve big problems and fill needs, same goes for crypto startups.

Before investing, ask yourself this question. Are these coins solving any problem?

When investing for the long term, it’s important to evaluate the team behind the project; their mission; plan to accomplish that mission and overall enthusiasm!

Focus on prospects with real value but stay away from questionable projects with shady founders

Crypto should be another source of income not your main. Do do your diligence research before you invest. For more research on altcoins… Coinmarketcap is a good place to start with.

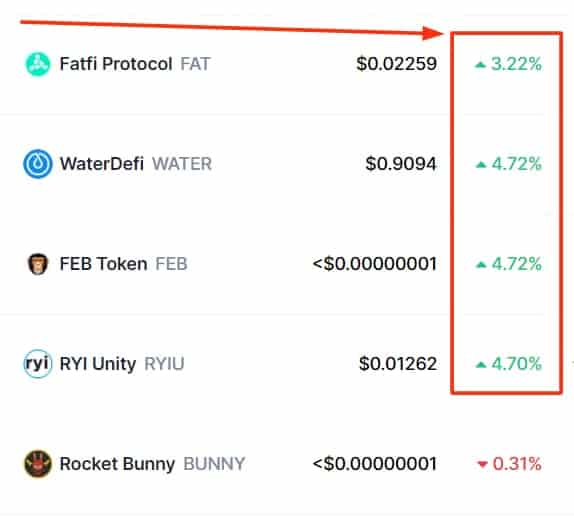

#2. Price History

How has this cryptocurrency been performing? Before you invest your money in any crypto, it’s important to check its history first.

Check the currency’s trending performance and compare that with other cryptocurrencies.

Cryptocurrency is a highly volatile market. This volatility can be attributed to speculation, hype, pump and dump schemes as well as lack of regulatory oversight.

Looking at a coin’s price history tells the story-the cheaper coins with lower market caps are more susceptible to these types of scams that result in big losses for investors if recognized early enough.

Another important factor to consider is the number of exchanges a coin is currently being traded on.

Is it available on most major trading platforms, or only smaller ones? Announcements about coins being added to larger exchange networks like Binance can affect their price significantly.

#4. Only Invest What You Can Lose

Now this is very important and cannot be over emphasized. Do not invest what you cannot lose that will be unwise.

Nothing is guaranteed about cryptocurrency and the market is very volatile. So for every money invested, have at the back of your mind that you’re risking it.

Having this knowledge should guide and help you not to invest what you cannot lose. Then also your risk tolerance should guide you.

Don’t stake what you can’t risk, it’s as simple as that.

#5. Diversify Your Portfolio

Lastly, don’t put all your funds in one asset. Simply put, avoid putting all your eggs in one basket. Diversify your investment.

Diversification serves as a means to manage risks by mixing different cryptocurrency investment strategies.

Here, your goal should be to create a group of investments that exposes your portfolio to as many different areas to help reduce the overall risk of your investment.

The idea is that your portfolio can withstand negative events without losing too much value in the worst case scenario.

For example, your investment portfolio only consists of 60% Bitcoin and 40% Litecoin. With the look of things, that is not a well-diversified portfolio.

You are only exposed to two investments. In case the price of Bitcoin drops, you’ll likely experience a drop in the price of Litecoin too. This means your portfolio balance will drop which is a serious risk.

Cryptocurrency Research Tools

Over 9000 cryptocurrencies have been launched since the inception of Bitcoin in 2009. So researching and keeping tracks of all these coins can seem nearly impossible.

However, with some certain tools we’re going to be discussing, you’ll have a better knowledge to make more informed decisions.

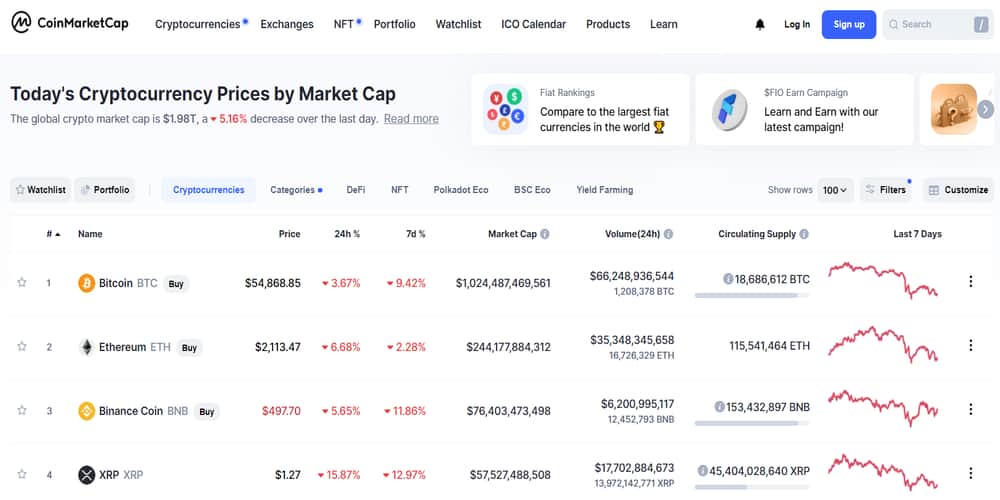

#1. CoinMarketCAP

CoinMarketCap should actually be your NO:1 goto when you want to start your crypto research on new altcoins.

They’ve been the starting point for all investors beginning their journey into the crypto market since 2013.

The most popular website in all of crypto, many investors use CoinMarketCap as an easy way to investigate new assets and gather information about the market.

Some of the best features on CoinMarketCap that makes the platform unique includes crypto ranking by market cap, altcoin supply metric, trading volumes across different exchanges like Binance and price historical graph.

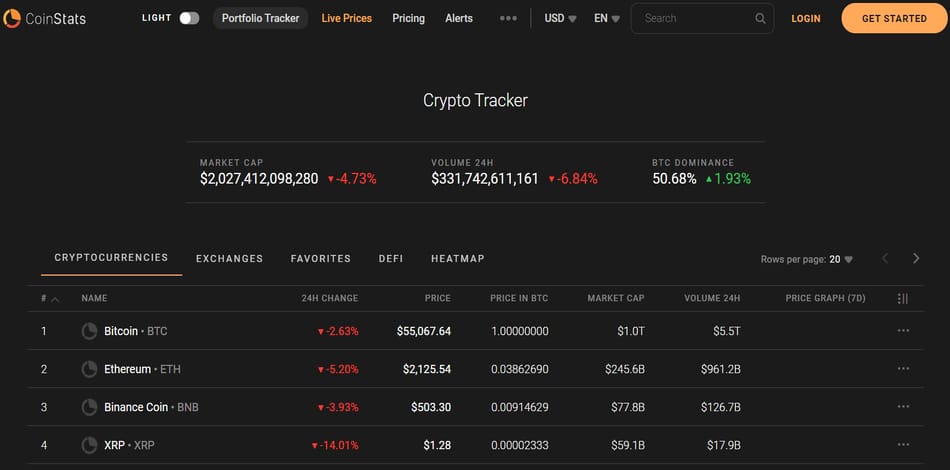

#2. CoinStats

Investing in cryptocurrency can be a big decision. That’s why it is important to stay up-to-date with news about your investments and CoinStats has made this easier than ever before!

This mobile application provides investors of all levels access to current crypto developments across exchanges.

Stay on top of new assets being released or even track your own portfolio for changes at any time using their real-time data tracking tool.

With the CoinStats application, crypto investors can keep up with the latest trends on cryptocurrency and receive notification about the market changes and other trending articles about cryptos.

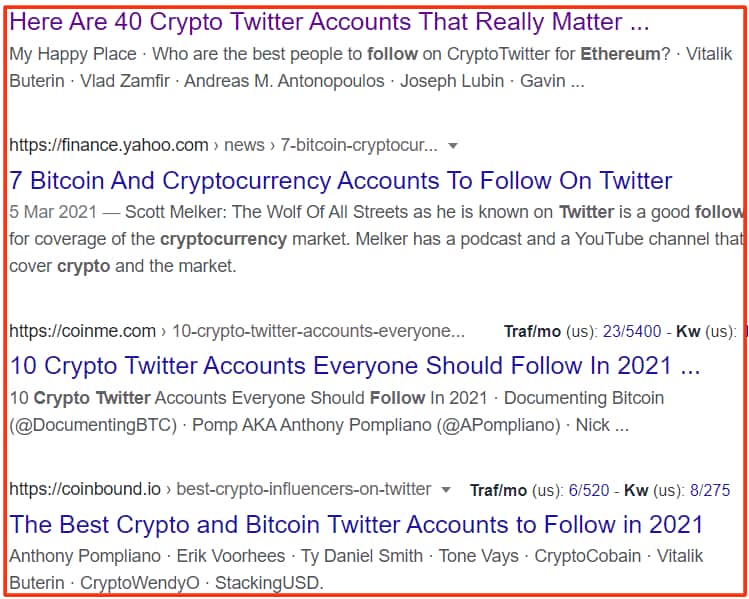

#3. Twitter

Twitter is a great tool for keeping up to date with the latest developments in crypto.

Some of the most influential players are on it, so by following them you can quickly find out what’s going on and make important decisions.

However, while Twitter might be an incredible source of information for Crypto lovers, it should also be used in conjunction with other resources to get your fact straight.

Conclusion

So basically, what you want to do is look for cheap assets and invest in them while they’re still extremely cheap.

Acquiring a single coin like the popular bitcoin might not seem possible as a wise investment because you’ll be risking too much.

But with the cheaper new altcoins, you can buy as much as you can with a relatively cheap amount. But make sure you do your diligent research before investing in any coin.

And once you’re ready, head over to BINANCE to start buying your preferred cryptocurrency and save them.

Best part? You can also save them using the Binance wallet. So that’s it on how to invest in cryptocurrency in Nigeria.

Let me know what you think about this post in the comment section.

![15 Best Investment Apps In Nigeria [Smart Online Savings]](https://smartbizfreedom.com/wp-content/uploads/2020/04/Add-a-heading.jpg)

![Royal Q MLM Referral System Explained: [Earn $1071 Daily]](https://smartbizfreedom.com/wp-content/uploads/2023/11/Royal-Q-referral.jpg)

Wants to make money online can you help me sir, God bless you