Paystack Review – Pan African Payment Gateway?

Trying to learn more about Paystack payment solutions? Here’s a Paystack review on everything you need to know about Paystack.

The growth of e-commerce and technological advancement globally is at a tremendous trend. This is to the extent that the coming generation might have to go paperless with financial transaction in the nearest future.

However, the same could not be said for the third-world countries in Africa part of the continent. This is because the Europeans countries and the U.S enjoy much faster development with e-commerce compared to these countries.

The seamless financial transaction has not been easy in third world countries. Most especially when the big guys like PayPal, Stripe, etc. limit their functionality to this area of the world.

However, the launch of Paystack has brought about hope for Nigerians and the rest of the African countries. So, let see what they’ve brought to the table.

Paystack Review: Overview

Paystack is basically a payment processor that helps to facilitate online transactions for e-commerce businesses in Nigeria.

Currently, Paystack is been used seamlessly by over 30,000 businesses in Nigeria including Torchbankz Technology.

This is with a frictionless payment transaction through the following means:

- Card

- GTB 737

- Bank Account

- Visa QR

- Mobile Money

While they plan to add additional channels like POS and mCash in the nearest future. However, the top question asked by Nigerians is whether or not; Paystack, can receive international payment?

Fortunately, Paystack accepts card payment from any part of the world. The best part is that this payment is processed and remitted in Naira currencies to individual business accounts.

The exchange rate is, however, going to be determined by your banks immediately your payment is settled within 24hours. Excepts for transaction carried out on weekends and public holidays.

The other side to this is that the international payment is not available by default. What this means is that in other for you to facilitate international payments, it has to be on special request.

You have to submit a special request alongside your business registration document to Paystack. Once everything is processed your business can start receiving an international payment within 24hours. Thanks to Paystack.

Paystack Payment Integration

Paystack tries as much as possible to make e-commerce transactions seamlessly through their various sophisticated API integration and several plugins.

If your business website is built on any of the below platforms, you can easily integrate Paystack in under 10 minutes.

- WordPress

- Shopify

- com

- Opencart

- Magento

- PrestaShop

- SQUARESPACE

- Joomla!

- Abantecart

- Drupal

- CS-Cart

- OSClass

- SPC SMS

WordPress, being the largest of these platforms have extended plugins that easy works with Paystack for payment conveniences. The Plugins include:

- Enginethemes

- Paid Membership Pro

- Sprout Invoices

- WP Jobster

- Premiumpress

- Payment Forms

- WooCommerce

Paystack payment integration is flexible to accommodate any kinds of business. Be it e-commerce store owners or freelancers.

The best part about Paystack payment integration is that you don’t need to own a business website to get paid. Even with a simple Facebook page, you can receive payment via Paystack.

For those that don’t have a website and less familiar with coding can settle with Paystack payment pages and invoices.

With this, you can easily send your customers invoice while they make the payment without necessarily creating an account with Paystack.

Paystack Go!

Paystack Go is a mobile version of the existing Paystack. We all know it’s not easy to take along your laptop to every location. Hence the Paystack Go.

This is fundamentally built for merchants on the move! Since an average merchant is always on the go. A meeting here and a seminar there.

So Paystack deems it fit to create a mobile bird’s eye view dashboard for everything that going on with your business. Rather than squeezing the existing Paystack dashboard into a mobile version screen.

So what can you do with Paystack Go?

There are some specific features you will find on Paystack Go that’s not available on the Desktop version. Let’s take a look at few of them:

- Paystack Go Works Offline

Paystack Go works quietly in the background, collecting important data about your business when the network is good. This is specifically built to withstand bad network because such is only typical in many African cities.

After saving the most important information when the network is good, it then serves you this information whenever you need it. Irrespective of the current network situation.

So, no internet? No problem! Paystack Go I’ve got you covered!

- Business Performance

With Paystack Go, you can easily track your business performances to see your daily, weekly and monthly transaction revenue.

This includes the number of payments, available balance, and rates of successful transactions all in one glance.

- Send Invoices

Paystack Go allows you to easily send invoices to your client as easy as a text message. Easily request payment from customers and they’ll be able to pay securely online.

It will also allow you to easily track who has paid and how much they’ve paid. And finally, you’ll also get a push notification on your mobile device whenever a customer takes any specific action.

Paystack Chargebacks Management

If you’ve had some experience selling online, you’d understand the importance of chargebacks management.

A chargeback is a refund request that your customer makes at their bank. This could be when they believe they’ve been cheated or they haven’t received value for their money. It could even be the other way round.

Business owners or merchants are required by the issuing bank to respond to such request within 24 hours. If not, the refund request will be automatically approved. And the seller/merchant will be debited.

Paystack system is designed to allow merchants to have better control and more visibility into the chargeback claims made by their customers.

This works in a way that there will be a notification sent to each merchant email whenever a claim is made against them. This will allow them to quickly log into their Paystack dashboard to either accept the claim, or dispute against it with evidence.

Paystack Pricing

First thing first you have to understand that using Paystack is absolutely free. You don’t have to pay a dime until your customer starts paying you.

And this can actually be pass across to your customers. Here’s the deal, before you can start using Paystack your business must be registered in Nigeria.

It’s until your business credentials are reviewed and approved that you can start using the platform successfully.

Otherwise, all you can do is test payment transactions in the test mode instead of the live mode.

About payment, as I said earlier they charge you when you’re actually making money. So, it’s a win-win situation for both Paystack and its users.

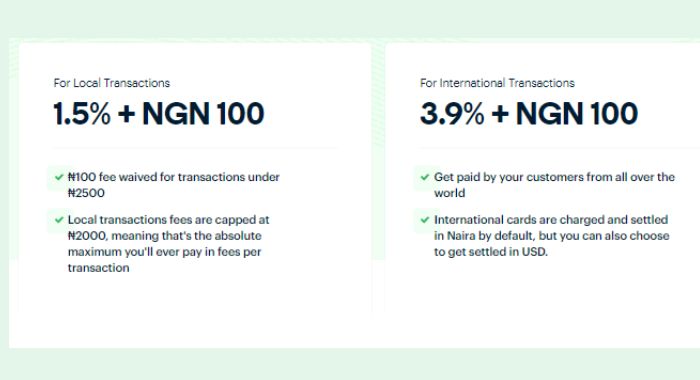

Paystack charges are of two types:

- Local transaction and

- International transaction

For local transactions, 1.5% of the transaction amount will be charged with a flat rate of NGN 100.

For example, an NGN 5000 transaction is going to cost you NGN 175 plus NGN 100 flat rate. So, your settled payment is going to be NGN 4,825.00.

However, any transaction that doesn’t add up to NGN 2,500 will not be charged the NGN 100 flat rate. Also, you should know that the Paystack cap fee is NGN 2,000, even for transactions that are above NGN 1 million.

This means the highest fee you can think of paying to Paystack per transaction can never be above NGN 2,000. Irrespective of the transaction amount.

While the second transaction been the international payment is a bit higher than the local transaction. Paystack charges 3.9% on the international transaction with NGN 100 as a flat rate.

Just like the local transaction, you can decide to add the fee to your products and service. This way you won’t have to pay any extra cost to Paystack.

All costs will be paid alongside the product/service cost by your customers, which is a win-win situation for both you and Paystack.

How Secured is Paystack?

This is only a fair question since money is involved. We all know how skeptical people can be when it comes to online transactions in a country like Nigeria.

The platform is secured in several ways that’ll be hard to breach.

First, all customers’ card details are encrypted using AES-256 GCM while the decryption is store on a separate machine. With this, you don’t even have to worry about personnel or employees in Paystack having access to your card details.

Needless to say, Paystack itself is a PCI-certified, auditor certified and PCI Service Provider Level-1. Which is the highest certification level.

All connection to Paystack services is processed on HTTPS using TLS 1.2 (SSL). Paystack platform also ensures that browsers interact with Paystack only on HTTPS.

Finally, the issue of fraud. Paystack also has in place an internal decision support system. This system uses an intelligent rule to determine the risk factor of any transaction.

Any transaction that does not pass the necessary checks will be blocked from been completed. This process is based on a combination of multiple factors such as geolocation location, purchase and behavior history, IP addresses and so on.

In addition to this, every merchant is allowed to whitelist or blacklist any customers that have been fraudulent from their dashboard.

Paystack Insight and Report

The Paystack insight and report is another interesting feature on Paystack. This insight allows you to monitor your business trend and use data gathered to adjust your business strategy.

This insight allows you to monitor all your:

- Paying Customers

- New Customers and

- Returning customer

Such insight will also allow you to know when your customer interacted most with your business. Reports like these can be further restructured to create a targeted ad campaign for your business.

Obviously, when you’re running a campaign you should see an increase in your business interaction. If not, then you’ll understand that your campaign is not converting or set up properly.

Paystack Support

Live chat support is available on Paystack via the merchant dashboard. This is, however, available for existing users only.

For those that don’t have a Paystack merchant account, they can contact Paystack through this form page.

What Are the Shortcomings of Paystack?

Well, not all is sunshine and roses with Paystack payment solutions. They have quite some shortcomings themselves. I’ll mention them subsequently:

- Limited to Nigerians

Paystack is currently limited to Nigerian merchants only. This mean business owner from other parts of the world or African nation cannot benefit from their services.

However, they recently launched their service in Ghana but it’s yet to be active since it’s still in a beta mode.

- International Payment

The international payment option is not by default available on the platform which could have been their major strong point if available.

In other, for business owners to use Paystack international payment solution, they have to do so on request which is a total turnoff.

Paystack Review Conclusion

Paystack is basically best for business owners registered in Nigeria. This could be any kind of business not necessarily a website owner.

However, we should understand that they are still a startup company that’s still undergoing major growth.

Which obviously since inception in 2015 till now has seen tremendous growth. That’s it on Paystack review… sure let me know how your experience as been so far with them.

![How to Open a Stripe Account in Serbia [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-33-1-768x432.jpg)

![How to Open a Stripe Account in Bahrain [Very Easy and Legal]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-38-768x432.jpg)

![How to Open a Stripe Account in Thailand [2023] – Works 100%](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-Thailand.jpg)

![How to Open a Stripe Account in Indonesia [2023] – Works 100%](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-Indonesia.jpg)