Branch vs PiggyVest – Ultimate Comparison 2023

Branch or PiggyVest? Which should I use? In this article; “Branch vs PiggyVest”, you will discover the best answer to that question at the end of this post.

We will go over the following:

- Both companies’ overview

- Their features

- Key differences

- Existing user reviews

- Pros and Cons, etc.

We placed Branch and PiggyVest side by side, and here is what we believe to be true about them.

Let’s jump right in!

Contents

- Branch Overview

- PiggyVest Overview

- Branch vs PiggyVest: Key Differences

- Branch vs PiggyVest Reviews

- Branch vs PiggyVest: Pros & Cons

- Branch Pros & Cons

- PiggyVest Pros & Cons

- Frequently Asked Questions

- Conclusion

Branch Overview

Branch app is a fintech company designed to provide loans of up to N500,000 within minutes and other banking-related services.

The branch app was founded in late 2015 in Kenya by Daniel Jung and Mattew Flannery, and it later became available in Nigeria in late 2017.

The branch loan app is growing fast among fintech companies because it offers various unique services.

With the branch app, you can apply and get funds disbursed into your account within 24 hours without going through several verifications.

No collateral, no paperwork whatsoever.

The branch loan app also provides investment services for its app users.

With the branch app, you can get up to 20% annual interest rate on your savings.

The good news is that it also offers flexible withdrawal so that you can easily access your fund anytime you need it.

In addition, you can also pay all your bills with the tap of a button, including Airtime and data bundles.

You can send and receive payments from other bank users. This is an added advantage to the platform.

The branch loan app has also gone a step further by introducing a branch debit card which you are entitled to when you sign up with them.

The best part? No hidden charges – no fees on withdrawals – no cost of ATM card maintenance.

That is crazy. – Yes, it’s!

The branch app also has other unique features, which you will discover when you start using the app.

Branch Features

Let’s talk about the branch loan app’s unique features!

1. Branch Savings

When you open a branch account, you can opt-in for branch savings, which helps you grow your funds quickly.

When you start saving, you are entitled to get up to 20% annual returns.

The good news is that the branch offers flexible withdrawals to get your fund out in terms of urgent needs quickly.

2. Branch Debit Card

The branch loan app debit card allows you to enjoy easy cash withdrawals nationwide.

With the branch app debit card, you can make withdrawals for free across all the ATMs available in the country.

The ATM card doesn’t also carry any cost of maintenance – that means everything is free.

3. Quick Loan

Life happens, and we need fast and quick cash to make things work.

These unplanned incidents come knocking on our doors when we don’t plan for them.

We need quick cash to sort them out if we must keep going.

The people we trust the most and whom we can quickly get a loan from might disappoint us.

But worry no more; with the Branch app, you can get a quick and fast loan.

All you need to do is to apply – your loan will be approved within 24 hours.

If getting loans is the primary reason you are reading “Branch vs PiggyVest”, this is good news.

4. Bills Payment

Going out to pay bills at times can be stressful.

Worry no more because, with Branch, you will be able to pay all your bills from the comfort of your home.

You can pay for utilities and TV and get airtime for yourself and loved ones at a discount.

Read more: How to download the Branch loan app

PiggyVest Overview

PiggyVest, formally PiggyBank, is a financial institution designed to help people reach their financial goals by helping them invest their money into real businesses and get profits.

Users give their money to PiggyVest by making savings on the platform.

The platform was founded in late 2016 and has since gained popularity among digital savings apps.

It currently has over 4 million users across the African countries it operates.

You can easily access various investment opportunities on the platforms. All the investments listed there are pre-vetted.

One of the platform’s advantages is that it has a savings plan for categories of people.

Regardless of your financial status, you would always have a sit on PiggyVest.

We came to this conclusion when we discovered that you could save as little as N500 on the fintech app.

And invest as little as N2,500 for investment listed on the platform.

The investments are like shares, so you only buy based on your financial capability.

In addition, security is the platform’s utmost priority, meaning that your data and your money are safe.

These and more have gotten PiggyVest featured on many reputable online platforms.

PiggyVest Features

Let’s talk about the PiggyVest features, which I believe are essential things you need to know.

1. PiggyBank

PiggyBank is the first product of the app, and it remains one of the most valuable products of PiggyVest.

This feature allows you to save automatically daily, weekly, or monthly. PiggyBank has an auto-save feature that automatically debits your wallet a certain percentage to your savings at set times.

All that is required is to ensure you always have enough funds in your PiggyVest wallet to cover the savings.

Want to avoid automatic savings? Don’t worry; you can always manually top-up your picked bank account anytime, anywhere.

You are entitled to get up to 10 per annual for this savings option.

In addition, to help you build discipline, PiggyVest has four free withdrawal days in a year.

Suppose you want to withdraw before the maturity or free withdrawal day. A cost is applied to you.

2. Flex Naira

The Flex Naira is a product designed to help you receive and withdraw naira at any time.

You can also see the Flex Naira account like your savings account which you can always save and withdraw from at any time.

With a Flex Naira account, you can save for emergency days and be able to withdraw at any point in time.

One of its advantages is that by allowing your money to sit down in your Flex Naira account, you will get up to an 8% interest rate annually.

Note: Here, you are not limited to 4 free withdrawals a year, you can always get your money at any time, which is why it’s Flex Naira.

Learn more: PiggyVest interest rates per month

3. Target Savings

Target savings on the app is designed to help you reach your savings goals faster.

With target savings, you can customise the rules and duration of your target savings as you wish.

The duration is how long you want to save money before you can withdraw it.

If for any reason, you want to withdraw the money before the agreed date, then a penalty is applied to you.

The reason is that the money you save with the platform, PiggyVest also gives it to make money for you.

You will get up to 10% annually for using this savings plan.

4. Safelock

Here, you can lock money for a specific period without having access to your money until maturity.

It is just like having a traditional fixed deposit account. This account type offers up to 12.5% per year, which is the highest rate.

I love this plan because it helps you stay disciplined and avoid the money temptation everyone faces.

In addition, your 12.5% is paid upfront.

This means that your interest will be deposited into your account when you begin your savings.

5. Investify

Investify is the investment options or opportunities on the platform.

This is where real businesses are listed, and you can choose from anyone.

Here, you can invest in farms, real estate, or any business from all walks of life.

You also can own real property or have a share of real estate and receive rental income every year.

All businesses listed here are pre-vetted to ensure users’ security. Listing harmful business investment programs would lead to declining app usage activity.

Read more: PiggyVest vs Kuda-which is better?

Branch vs PiggyVest: Key Differences

- The significant difference is that the Branch app is popular as a micro-loan lending platform, while PiggyVest is an online savings app.

- The branch loan app isn’t available on App Store, but PiggyVest is available on App Store.

- The branch loan app issues a debit card to its customers while PiggyVest doesn’t.

- The branch loan app has been around for a while now than PiggyVest.

- The branch loan app helps you build credit while PiggyVest doesn’t.

Branch vs PiggyVest Reviews

Here, we will look at what existing users of both platforms are saying about them to help you make an informed decision.

We will look at the over-raw rating, good and bad reviews.

Let’s look into it!

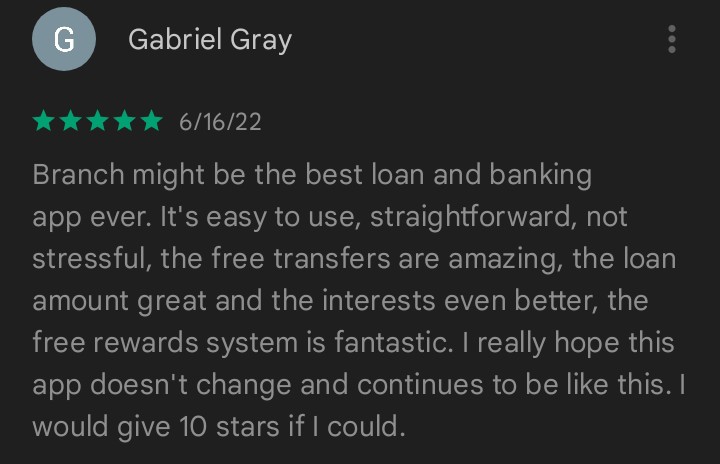

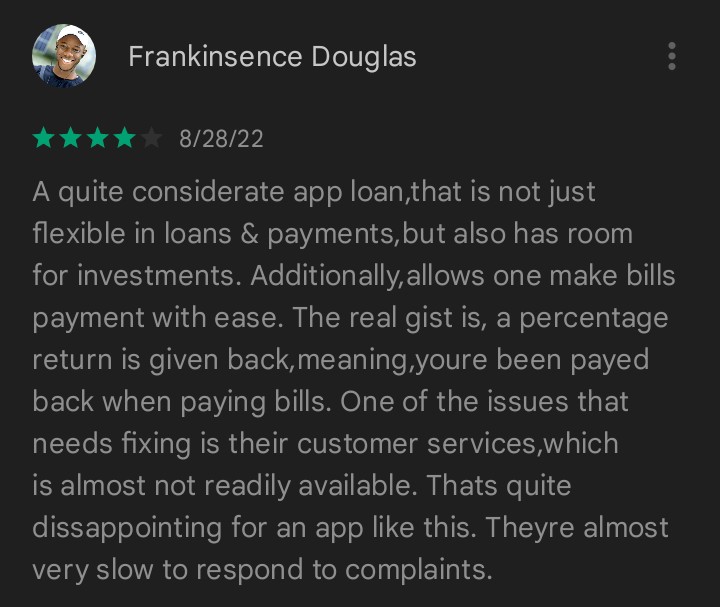

Branch Reviews

As of the writing of this article, Branch has an overall rating of 4.5 out of 5 and over 858,000 reviews.

Let’s take a look at what users are saying.

If you want to learn more about what people are saying, kindly check the Google play store.

PiggyVest Reviews

At the time of writing this content, PiggyVest has an overall rating of 4.1 out of 5 and over 43,000 reviews.

Let’s take a look at what people are saying.

Branch vs PiggyVest: Pros & Cons

Let us go through the pros and cons of each app.

Branch Pros & Cons

The branch pros will come first, and then the cons will follow.

Branch Loan App Pros

- It helps you build credit which can help you get more loans.

- Get instant loans within minutes.

- Earn up to 20% returns on your savings.

- Reliable, fast, and quick transfers from your wallet.

- Pay all your utility bills with the tap of a button.

- Reliable customer support.

- No hidden fees or charges.

- Access to a branch loan app debit card for being a customer.

Branch Loan App Cons

- Advance amounts limited

- You must have a debit card from supported banking before getting a loan.

- Loans are not available to remote employees.

PiggyVest Pros & Cons

Here, we will be looking at the pros and cons of PIggyVest. The pros first and the cons later.

PiggyVest Pros

- Flexible and easy savings for all categories of people.

- You can quickly become addicted to savings which is a great idea.

- Access your money anytime on some of PiggyVest products. Excellent and reliable investment opportunities.

- Earn good returns on all of your savings.

- You quickly grow wealth over time.

- It is trusted by many and regulated by the CBN.

PiggyVest Cons

- Customer service is poor.

- A 5% service charge is applied when you break your savings before maturity.

Frequently Asked Questions

Let us go through frequently asked questions we often get from our blog users.

1. Branch vs PiggyVest: Which is Better?

PiggyVest is better regarding savings and investment opportunities, while Branch loan is better as a mobile banking app and getting micro-loans.

2. Branch vs PiggyVest: Where Should I Save my Money?

In terms of savings, PiggyVest is the best place to save your money because it is majorly designed for savings and investment opportunities.

3. Is Branch Good for Mobile Banking?

Yes, the Branch loan app is perfect for mobile banking, and you can quickly discover this when you start using it.

4. Branch vs PiggyVest: Are they Regulated by CBN?

Yes, Branch and PiggyVest are regulated and licensed by the CBN, which makes you be on the safe side.

Conclusion

As you can see that both apps are really good in what they do and have some pretty features to offer.

However, if your main reason for looking into “Branch vs PiggyVest” is that you need a reliable platform for savings.

Then, PiggyVest would perform just really well because it has everything you will ever need to carry out all your savings activities successfully.

On the other hand, if you need an app to get quick loans and pay your bills.

Then the Branch loan app would work because they’re one of the leading in the loan industry.

With that being said, we have come to the end of “Branch vs PiggyVest” do let me hear your thought in the comment section below.

![How to Open a Stripe Account in Philippines [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-Philippines.jpg)

![How to Open a Stripe Account in Jordan [100% Legal Tutorial]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-4-768x432.jpg)

![How to Open a Stripe Account in Bolivia [Step by Step]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-7-768x432.jpg)

![How To Open A Payoneer Account In Albania [Get $50 Bonus]](https://smartbizfreedom.com/wp-content/uploads/2022/04/pp-768x384.jpeg)

![How to Open a Stripe Account in India [2023] – Works 100%](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-India.jpg)