PiggyVest vs Kuda- The Ultimate Comparison in 2023

Are you here to learn about PiggyVest vs Kuda? If yes, then, you are in the right place because we will show you all there’s to know about PiggyVest and Kuda bank.

PiggyVest and Kuda are both fintech companies with minor similarities.

PiggyVest is designed to provide savings and investment opportunities for all categories of people.

Kuda is a simple, yet powerful mobile banking app and more.

If you would like to learn more about them in-depth, ensure you read till the end.

Let’s jump right in.

Contents

- PiggyVest Overview

- Kuda Overview

- PiggyVest vs. Kuda: Key Differences

- PiggyVest vs. Kuda: Reviews

- PiggyVest Reviews

- Kuda Reviews

- PiggyVest vs. Kuda: Pros & Cons

- Frequently Asked Questions

- Final thoughts

PiggyVest Overview

PiggyVest is a fintech company designed to help people save, invest and reach their financial goals faster.

The PiggyVest app was introduced in late 2016 when it was first name PiggyBank and later rebranded to PiggyVest.

Since its launch, it has been operating legitimately and has some excellent features in store.

Since writing this content, PiggyVest has helped over 4 million users achieve their financial goals through savings and investment features.

Anybody from anywhere in the world can permanently save with PiggyVest.

You can start saving as low as N500. You can also own properties when you invest in real estate businesses listed on the platform.

Security is of the utmost priority of the platform, which means that your data and your money are safe on the platform.

These and more have gotten PiggyVest featured on many reputable online savings platforms.

Read more: What is PiggyVest [Everything to know]

PiggyVest Features

Let us look at PiggyVest’s features so you can know exactly what to expect when you start using the app.

1. PiggyBank

PiggyVest was formerly named PiggyBank. It was initially a savings app before it rebranded to be a fintech app with various functionalities.

The PiggyBank feature remains a core feature of the app. You can save and withdraw money at any point in time without any restrictions. Your savings and withdrawals can be daily, weekly, or quarterly.

2. Safelock

Safelock as the name implies is like a fixed deposit account that allows you to save money in a savings account within a specific period of time.

The money that you save here isn’t withdrawable until the maturity date.

If you need to withdraw from your safe lock before the maturity date (set by you), you will be charged 2% of the amount saved.

This is put in place to encourage discipline. You are entitled to an upfront 12.5% interest payment when you commit to a safe lock savings plan.

3. Targets

This feature allows you to set a financial savings target. If you have a project and need a certain amount of money to fund it, you can save up cash for the project using this feature on PiggyVest.

You are entitled to a 9% interest rate when you start saving on PiggyVest target savings.

4. Flex Naira

The Flex Naira is the type of account designed to make it possible for you to save and withdraw at any time without restrictions.

Liken Flex Naire to your regular bank savings account.

When you save on your flex naira wallet, you are entitled to get up to 8% returns annually.

One excellent feature of Flex Naira is that you can always access your money at any point in time.

This feature helps you prepare for emergencies knocking on your door when you don’t plan for them.

5. Flex Dollar

The Flex Dollar account allows you to save in dollars.

In Nigeria, where the Naira continually falls in value compared to the dollar, it is wise to save in dollars.

The Flex Dollar feature on PiggyVest is one of the few apps in Nigeria that allows you to do so.

You are entitled to up to 10% annual returns for saving money in your Flex Dollar account.

So, if you have been looking for a way to keep your funds in dollars while you are in your home country.

Then, this is an opportunity for you.

Read more: PiggyVest interest rates [Unbiased Truth]

Kuda Overview

Kuda, also known as Kuda Bank and formerly Kudi Money, is a London-based start-up and digital-only bank operating in Nigeria since 2017.

It is a leading fintech company that provides banking services and payments of bills.

It is a mobile banking app that currently operates all of its banking services on its official mobile app.

The Kuda bank is widely known as the “bank of the free” because it takes little to nothing on its transaction charges.

You are entitled to 30 free bank transfers every month. After 30 bank transfers, you will be debited N10 no matter the amount of money you transfer.

You will be debited N10 even though you transferred N1 million, provided the money was transferred as a whole- not in parts or fractions.

Kuda bank’s sole aim is to help you get the best out of your money without the hassle.

Over 4.2 million people currently use Kuda bank because of its value proposition- free bank transfers. It also offers many unique features that cannot be overlooked.

Kuda has a saving feature which allows you to receive up to 15% interest rate.

The Kuda savings account allows you to make more money than you would by keeping your money in the bank.

Opening an account with Kuda entitles you to a free Kuda visa card. You only pay N1,000 when you request a new Visa card- may be in the event, you misplaced the free card.

Security is of utmost priority for the app. It uses so many latest advanced security features to protect its users and their money.

You can turn on “access mode,” also known as safety mode, within the app.

When this has been turned on, transactions will be restricted entirely via the mobile app.

If you misplace your debit card and are wondering what to do to protect your funds, you can quickly turn this feature on.

Read more: Is Kuda legit? What you to know

Kuda Features

Let’s talk about the Kuda features so you can know exactly what to expect.

1. Kuda Debit Card

When you sign up with Kuda bank, you are entitled to get a free Kuda debit card, as mentioned earlier. This card is delivered to you at no cost.

Yeah, the card is delivered to you for free.

Kuda bank doesn’t charge you a dime for debit card maintenance. Most banks charges between N50-N100.

To get the card, you only need to click on the card on the mobile app and order one.

You can track the card’s delivery progress within the mobile banking app.

2. Kuda Spend

When you register and become a Kuda account user. You are entitled to up to 30 free bank transfers every month.

When you look at it, that is obviously more than N15,000 saved on bank transfer charges every year.

After you have exhausted your free bank transfers, you will be debited N10 for every transfer made thereafter.

You are debited just N10 even though you are transferring N500,000, provided the money is transferred once.

3. Kuda Save

We can all agree that saving consistently can be challenging. Kuda bank makes it easier for you to save and earn interest in returns.

In order to begin your savings with Kuda, download the app and sign up by inserting your account details.

4. Kuda Budget

You will come to agree with me when I say that financial clarity is everything.

The Kuda bank budget will show you details of your spending so you can make better money decisions.

With the Kuda app budget, you will be able to see the details of where your money is going and how you are spending it.

You will also be able to create a budget that can help you track savings and your spending habit.

5. Kuda Borrow

This feature is designed for you to get an instant short-term loan without paperwork, collateral, or whatsoever.

You are also entitled to get an overdraft for being a Kuda bank user.

However, you are entitled to only get an overdraft on Kuda when you use your account regularly.

Like purchasing Airtime, paying all of your bills using Kuda pay bills features, and the like.

Note: In reality, it’s not easy to get a loan on the Kuda app. I have come to this conclusion because I am also a Kuda user and I’m yet to be eligible for a loan to the fact I use it regularly.

PiggyVest vs. Kuda: Key Differences

Let us talk about PiggyVest vs. Kuda differences.

- PiggyVest is a savings and Investment platform but Kuda is a mobile banking app.

- PiggyVest offers higher returns on savings than Kuda.

- You can’t pay utility bills on PiggyVest but you can do that on Kuda.

- Kuda issue a debit card to its customers but PiggyVest doesn’t.

- You can spend globally on Kuda by buying gift cards but you can’t do that on PiggyVest.

Read more: PiggyVest vs Opay

PiggyVest vs. Kuda: Reviews

Let us go through PiggyVest vs. Kuda reviews and see what existing users are saying about both platforms.

PiggyVest Reviews

At a glance, PiggyVest has an overall rating of 4.1 out of 5 and has over 43,000 reviews at the time of writing this content.

Let’s take a look at what users are saying.

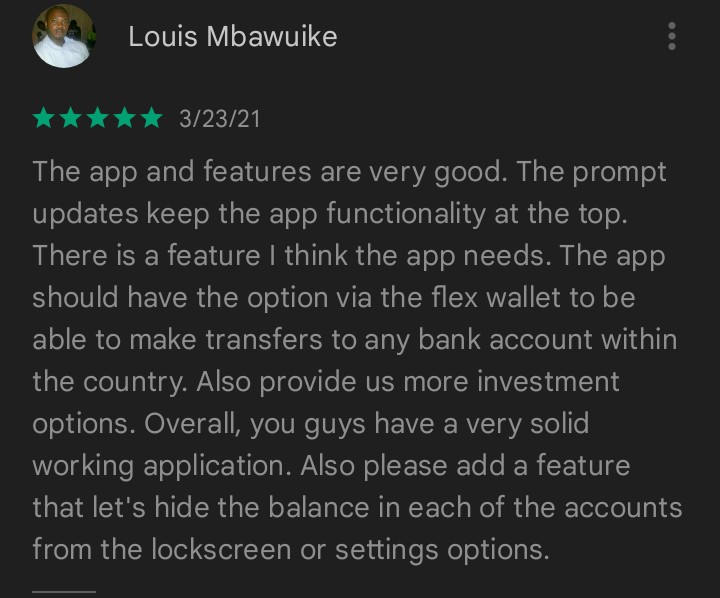

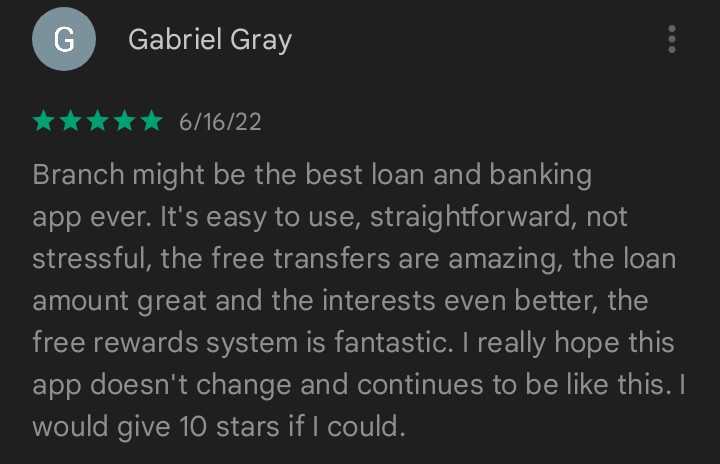

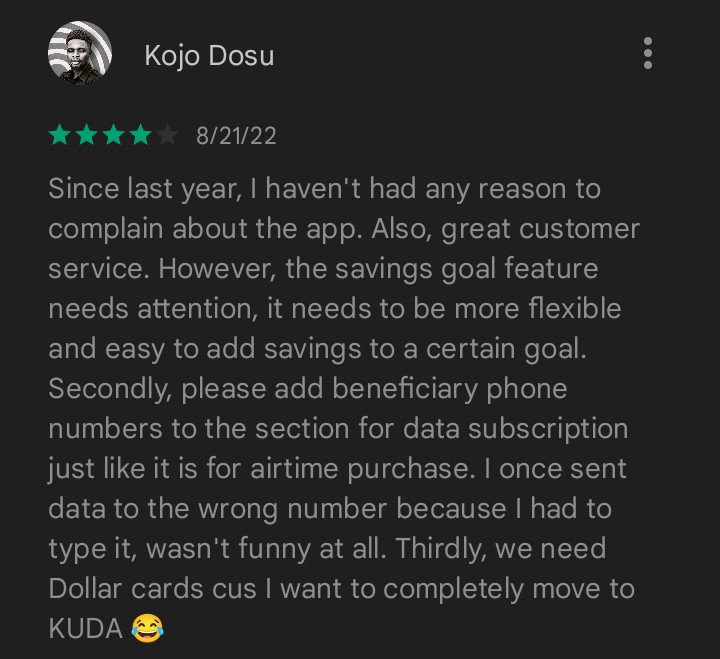

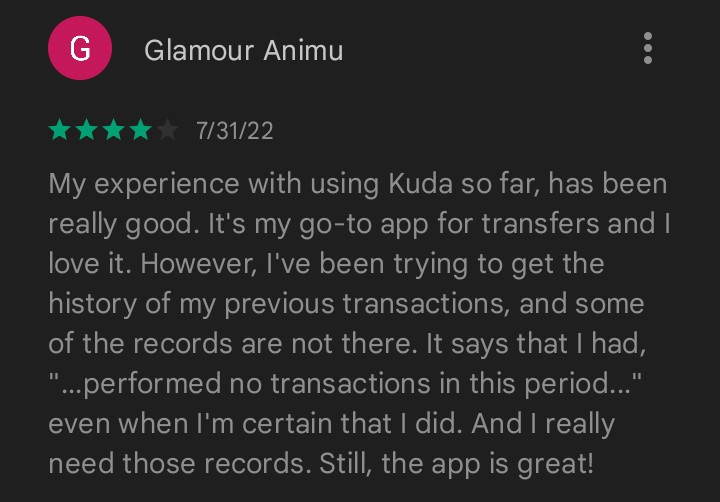

Kuda Reviews

Let’s also check Google to see what people are saying about Kuda bank also.

At a glance, Kuda has an overall rating of 4.5 out of 5 and has over 176,000 reviews at the time of writing this content.

PiggyVest vs. Kuda: Pros & Cons

Let us go through both platform pros and cons.

PiggyVest Pros & Cons

Here, we will be looking at PiggyVest’s pros and cons.

PiggyVest Pros

- Flexible and easy savings for all categories of people.

- Great and reliable investment opportunities.

- Earn good returns on all of your savings.

PiggyVest Cons

- Customer service is poor.

- A 2% service charge is applied to you when you break your savings before the maturity date.

Kuda Pros & Cons

Here, we will be looking at Kuda Bank’s pros and cons.

Kuda Pros

- Access to free Kuda debit visa card.

- Free 30 bank transfers in a month.

- Pay utility bills in minutes.

- Never-ending updates on the app.

- Beginners’ friendly user interface.

- The app has good security features.

Kuda Cons

- Poor customer support.

- The savings area is always affected by system glitches.

Frequently Asked Questions

Here, we will go through the frequently asked questions.

1. PiggyVest vs. Kuda: Which is Better?

PiggyVest is better in terms of savings and investment opportunities while Kuda is better as a mobile banking app.

2. Should I save my Money with PiggyVest?

Yes, you can save your money with PiggyVest and still have rest of mind. PiggyVest is pretty good when it comes to savings and investment opportunities.

3. Is Kuda Good for Mobile Banking?

Yes, Kuda bank is really good in terms of mobile banking and I would recommend it to anyone who is looking for a safe and reliable mobile banking app.

4. PiggyVest vs. Kuda: Are they Regulated by CBN?

Yes, PiggyVest and Kuda are regulated and licensed by the CBN which makes you be on the safe side.

Final thoughts

PiggyVest and Kuda are cool platforms in the areas they specialized in.

PiggyVest is best for savings and investment purposes. You are able to invest in thriving businesses from the comfort of your bedroom. Businesses listed on PiggyVest are legitimate because they all go through a verification process before they’re listed.

Kuda bank on the other hand is good for your day-to-day banking transactions.

It is also a good platform for paying all of your bills. You also have access to loans when you use your account regularly.

We have reached the end of PiggyVest vs Kuda, do let me hear your thought in the comment section below. Which do you prefer?

![Is Piggyvest Legit? [Everything You Need To Know]](https://smartbizfreedom.com/wp-content/uploads/2022/10/Piggyvest-legit-768x362.jpg)

![How to Open a Stripe Account in Senegal [100% Full Guide]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-18-768x432.jpg)

![How to Open a Stripe Account in Panama [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-5-768x432.jpg)

![How to Open a Stripe Account in Belize [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-58-768x432.jpg)

![How to Open a Stripe Account in Malaysia [Open & Verify]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-51-1-768x432.jpg)