PiggyVest vs Opay- The Ultimate Comparison in 2023

Do you need an unbiased PiggyVest vs Opay review? If yes, then you are in the right place.

We have hundreds of fintech companies around today, knowing the exact one to use might be difficult.

Yes, I understand because I have been there before.

After using over 20 fintech apps in the last few months, I have discovered that most offer similar services to nearly minor differences.

I have used PiggyVest and OPay, so you can be sure I am in the best position to tell review PiggyVest vs OPay.

Without wasting your time, let’s start immediately.

Contents

- PiggyVest Overview

- Opay Overview

- PiggyVestvs. OPay: Key Differences

- PiggyVest vs. OPay Reviews

- PiggyVest vs. Opay: Pros & Cons

- PiggyVest Pros & Cons

- OPay Pros & Cons

- Frequently Asked Questions

- Final thoughts on PiggyVest vs Opay

PiggyVest Overview

PiggyVest is a savings and investment platform designed for individuals to achieve their financial goals.

The fintech company was introduced to the market in late 2016 by Joshua Chibueze.

Its name then was PiggyBank because it aims to help individuals save money and make returns.

It was later rebranded as PiggyVest when other products were introduced, but PiggyBank remains the platform’s core feature since that is what it was built on.

Since its launch, the company has gained so much popularity across the countries it operates in because it offers so many unique features.

PiggyVest savings is for everyone, either poor, middle-class, or wealthy people.

This is because, with as little as N500, you can begin your savings on PiggyVest.

It also offers investment opportunities, through a feature known as “Investify”.

In addition, if you invest in a real estate business using the “Investify” option, you can own a piece of land or an apartment.

When you own an apartment in a building, you are entitled to receive a yearly rental income which goes straight to your PiggyVest account.

This can be seen as a long term investment that can help you build wealth over time.

If you have been looking for how to tap into the real estate business without breaking the bank. Then, this is for you.

Read more: What is PiggyVest?

PiggyVest Features

Let’s take a look at PiggyVest’s features.

1. PiggyBank

PiggyBank was the app’s main name when it was first launched, and it remains the main core function of the app.

Here, you can save and withdraw money at any point in time without any restrictions.

Your savings and withdrawals can be daily, weekly, or quarterly.

If you are a beginner who is looking for a savings app to get started with, this is fine for you.

2. Flex Naira

The Flex Naira is designed to help you receive and withdraw naira anytime.

You can also see the Flex Naira account, like your savings account, which you can permanently save and withdraw from at any time.

With a Flex Naira account, you can save for emergency days and be able to withdraw at any point in time.

One of its advantages is that you can get up to an 8% interest rate annually when you save with Flex Naira.

3. Safelock

Safelock, as the name implies, is like a fixed deposit account that warrants you to save money in your savings account within a specific period.

The money that you save here isn’t withdrawable until the maturity date.

If you need the money urgently and want to break your agreement, a penalty fee of 2% is applied to you.

This is put in place to encourage discipline among the savers and also the money you pay them as being used for other business purposes.

You are entitled to an upfront 12.5% interest payment when you commit to the savings plan here.

4. Targets

If you have to look at how you can save towards your dream goals, this is an opportunity for you.

This product is designed to help you go to your dream country, buy that dream car, build that dream house, etc.

Here, you can either save individually or with a group of like-minded people.

You can also join a savings challenge here, where you will be able to test your savings ability over a period of time.

You are entitled to a 9% interest rate when you start saving on PiggyVest target savings.

5. Flex Dollar

The Flex Dollar account is designed to save your money from inflation or other reasons that are best known to the owner of the funds.

All your transactions here in dollars, including save, invest, send, or withdrawals.

You can also transfer money from your Flex Dollar account to advance countries of the world like the USA and the like.

You are entitled to up to 10% annual returns for saving money in your flex dollar account.

So, if you’ve been looking for ways to keep your funds in dollars while in your home country, Flex Dollar is an opportunity for you to do so.

Opay Overview

OPay is a one-stop mobile-based platform for every individual’s payments, transfers, loans, savings, and other essential services.

Currently, OPay boasts of over over 18 million registered app users and 500,000 agents in Nigeria who rely on OPay’s services to send and receive money, pay bills, and many more.

OPay POS is widely used in Nigeria among POS users. This is because the OPay POS machine is one of the fastest in processing payments.

When you register on the OPay app, you can easily connect with family and friends by sending them messages, and they will be able to reply.

You can also send them money without paying a dime as charges via their P2P services.

To make life easier, OPay also provides offline banking.

You can carry out all your OPay transactions using its USSD code *955#. You can transfer money and pay some bills using the USSD code.

With OPay, you can save on the go and makeup up 15% annually on your savings.

Most importantly, security is of utmost priority of the app. It uses the latest and advanced security features to protect its users and their funds.

If you have been looking for one app to help you do all your banking transactions and more, then OPay is for you.

OPay Features

Now, it is time to take a look at OPay’s features.

1. Opay POS Terminal

The OPay POS terminal is designed to help POS agents carry out transactions effectively.

OPay POS is powered by Android and uses one of the fattest and latest networks to ensure fast transactions.

If you transfer money to OPay, the money will be credited instantly. This is good for those who do business with payments and transfers at all times.

Withdrawals using the OPay POS machine, on the other hand, is pretty fast and appear the fastest as of the time of writing this content.

2. OPay Bills Payment

You can pay your bills within the OPay app with a few clicks.

If you own an OPay POS terminal, you can also use it to make the bill payment.

3. OPay QR Code

OPay QR code is designed for you to send and receive payments quickly.

Swift transactions happen through the use of the QR code because your OPay information is encoded in the bar code.

I love this feature, and it is one of the things you should consider if you are going to use OPay.

4. OPay Pay TV

The OPay pay TV is a service designed to help you connect to your favourite channels.

With this service, you can pay for your TV services or your favourite TV shows.

This saves you the stress of paying TV bills in the bank or office if you’re a DSTV or GOTV user.

5: OPay Debit Card

OPay also typically issues a debit card to its customers. The ATM card works nationwide.

Its works on all ATMs and all forms of POS across the country.

You aren’t charged a card maintenance fee whatsoever for having the card. OPay takes care of it all.

PiggyVestvs. OPay: Key Differences

Let us take a look at the differences between both platforms.

- PiggyVest is a savings and Investment platform, but OPay is a mobile banking app.

- PiggyVest offers higher returns on savings than OPay.

- You can’t pay utility bills on PiggyVest but you can do that on OPay.

- OPay issues a debit card to its customers, but PiggyVest doesn’t.

PiggyVest vs. OPay Reviews

Let us take a look at what existing users of the app are saying about them by checking the Google Play Store.

PiggyVest Reviews

At a glance, PiggyVest has an overall rating of 4.1 out of 5 and has over 43,000 reviews at the time of writing this content.

Let’s check reviews of what existing users are saying.

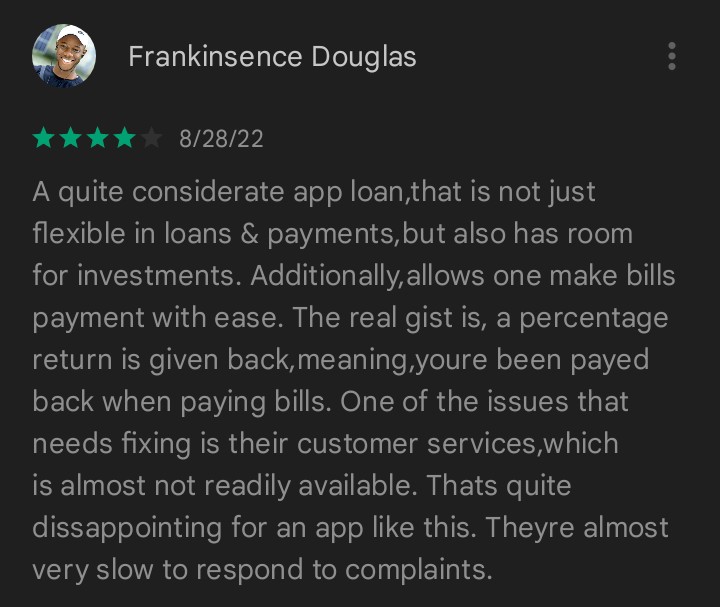

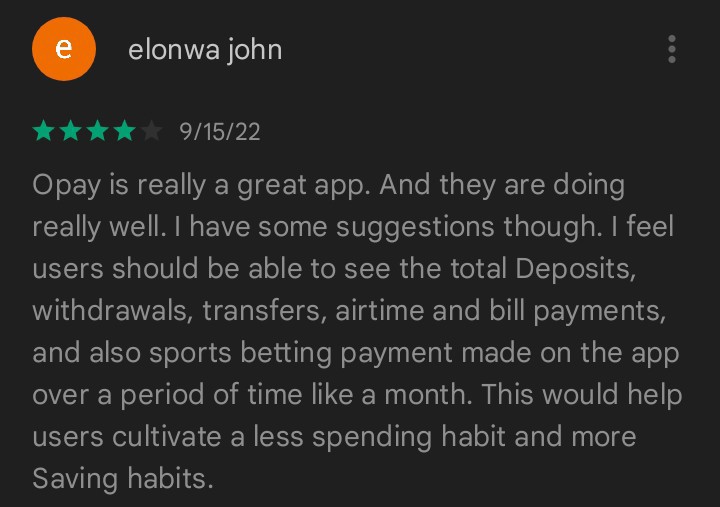

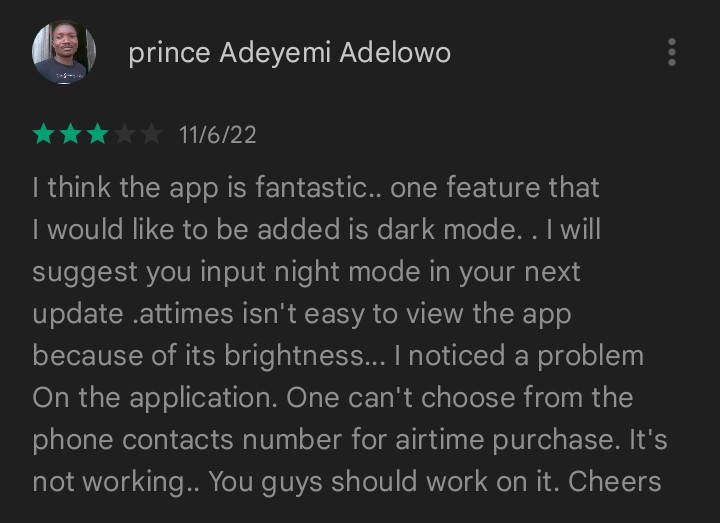

OPay Reviews

At a glance, PiggyVest has an overall rating of 4.14 out of 5 and has over 249,000 reviews at the time of writing this content.

Let’s check reviews of what existing users are saying.

PiggyVest vs. Opay: Pros & Cons

Here, we will be looking at the pros and cons of PiggyVest and OPay in order to make this content worth referring to as PiggyVest vs. OPay.

PiggyVest Pros & Cons

Here, we will be looking at the pros and cons of PIggyVest. The pros first and the cons later.

PiggyVest Pros

- Flexible and easy savings for all categories of people.

- You can easily become addicted to savings which is a great idea.

- Access your money anytime on some of PiggyVest products.

- Great and reliable investment opportunities.

- Earn good returns on all of your savings.

- You can easily grow wealth over time.

- It is trusted by many and regulated by the CBN.

PiggyVest Cons

- Customer service is poor.

- A 5% service charge is applied when you break your savings before the maturity date.

OPay Pros & Cons

Here, we will be looking at the pros and cons of OPay. The pros first and the cons later.

OPay Pros

- Access to 3 free bank transfers every day.

- Instant settlement of transactions.

- Free POS terminals for active merchants on its platform.

- Easily pay all your utility bills within a few clicks.

- The app is well designed and beginners friendly.

OPay Cons

- Poor customer service

- The app doesn’t lock automatically after a transaction, exposing your funds to theft.

Frequently Asked Questions

Here, we will be going through frequently asked questions people often ask about PiggyVest vs. OPay.

1. OPay vs PiggyVest: Where Should I Save my Money?

In terms of savings, PiggyVest is the best place to save your money because it is majorly designed for savings and investment opportunities.

2. OPay vs. PiggyVest: Are they Regulated by CBN?

Yes, both platforms are licensed and regulated by the CBN. In addition, they have obtained necessary licenses for operations across the countries.

3. Can I Trust PiggyVest with my Money?

Yes, you can save your money with PiggyVest and still be able to sleep with your two eyes. PiggyVest is regulated by the CBN and SEC. Your funds are safe and secured with PiggyVest.

4. PiggyVest vs OPay: Which is Better for Mobile Banking?

OPay outsmarts PiggyVest in terms of mobile banking because the OPay app is majorly designed as mobile banking and can pay all of your bills in minutes.

Final thoughts on PiggyVest vs Opay

PiggyVest will be the perfect idea for you if you want a platform to help you save and invest your money legitimately.

While OPay, on the other hand, is best if you need a mobile banking app that can help you do your mobile banking transactions.

With that being said, we have reached the end of PiggyVest vs OPay.

Which app do you intend to use? OPay or PiggyVest? Why? Let me know in the comment section below.

![How to Open a Stripe Account in Honduras [Working 100%]](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-Honduras.jpg)

![Is chipper cash Legal? [Everything To Know]](https://smartbizfreedom.com/wp-content/uploads/2022/07/is-chipper-cash-legal-768x412.jpg)

![How to Open a Stripe Account in Gibraltar [2023] – Works 100%](https://smartbizfreedom.com/wp-content/uploads/2021/10/stripe-in-Gibraltar.jpg)

![How to Invest in Chipper Cash [Step By Step]](https://smartbizfreedom.com/wp-content/uploads/2022/07/how-tp-invest-in-chipper-cash-768x412.jpg)

![How to Open a Stripe Account in Peru [100% Legal]](https://smartbizfreedom.com/wp-content/uploads/2023/12/Stripe-nepal-9-768x432.jpg)